Why the Strong U.S. Dollar Hasn’t Dragged Down the Global Economy

Neil Shearing of Capital Economics contends that despite the vigorous surge of the U.S. dollar, the prospect of a succession of global currency crises appears remote.

While the soaring dollar may unsettle global financial markets and raise concerns about currency stability for economies worldwide, Capital Economics suggests that the fallout may not be as dire as feared.

The recent robust performance of the U.S. dollar, as evidenced by the ICE U.S. Dollar Index DXY, has been consistent, marking a four-month streak of gains. This strength mirrors the resilience of the U.S. economy, fueled by sustained domestic demand and persistent inflation, empowering the Federal Reserve to prolong higher interest rates and defer expectations of an initial rate reduction.

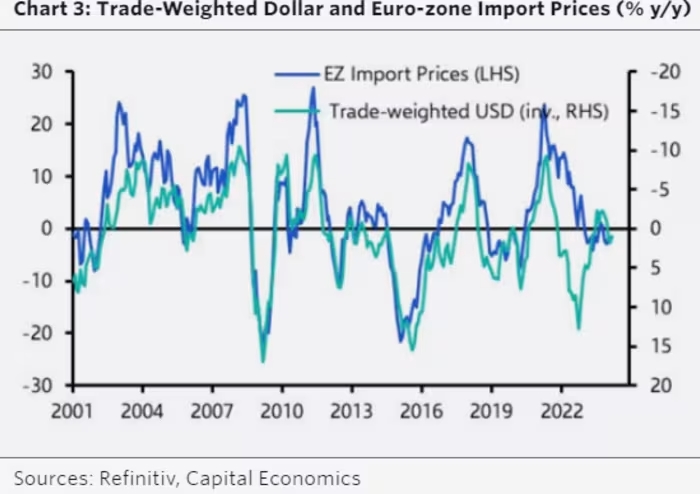

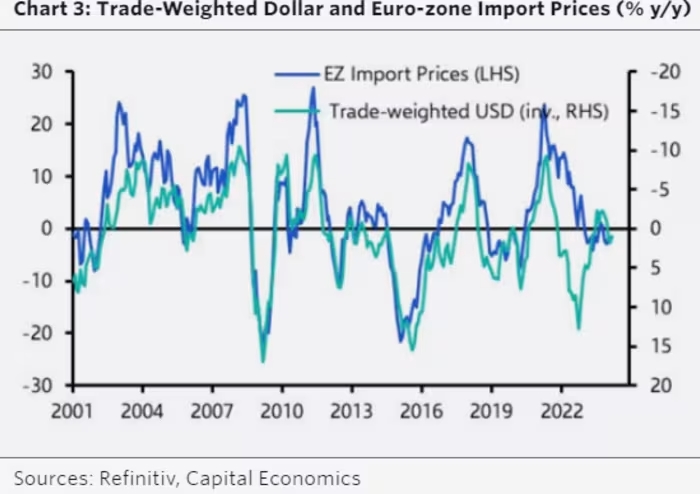

Despite the advantages a strong dollar offers U.S. consumers, such as curbing inflation and facilitating cheaper international travel, it could present challenges abroad. Neil Shearing, Chief Economist at Capital Economics, warns that the inflationary pressure on imports due to a strong dollar might hinder global trade and economic activity, particularly for countries outside the United States.

Furthermore, the appreciation of the dollar elevates the cost of dollar-denominated debts abroad, introducing uncertainty and potentially destabilizing financial markets.

However, Shearing reassures that the recent ascent of the dollar has been gradual, minimizing the likelihood of triggering widespread currency crises in other nations. Moreover, the impact of a strong dollar on global inflation varies depending on several factors, including an economy’s import intensity and the magnitude of currency fluctuations.

Contrary to conventional wisdom, Shearing observes an inverse correlation between the dollar’s strength and global import price inflation. This is largely due to the dollar’s influence on commodity prices, which tends to mitigate inflationary pressures.

Additionally, while a robust dollar may dampen global trade, other factors often overshadow this effect in practical terms.

Shearing’s analysis highlights the interplay between the dollar’s movements and changes in global GDP, suggesting that economic growth drives fluctuations in the greenback rather than the reverse.

Consequently, while U.S. stocks were showing positive momentum during the time of his assessment, led by technology giants like Tesla and Apple, Shearing emphasizes the nuanced relationship between the dollar’s strength and broader economic dynamics.

Recent Posts

Apple Shares Slide—What Investors Should Know

Apple Faces Tariff Uncertainty but Has a History of Exemptions Apple’s strong brand loyalty, high…

Beyond Tariffs: More Uncertainty for Investors

Investors anticipating market stability after President Trump’s April 2 tariff deadline may need to prepare…

Global Stocks Outshine U.S. – Exceptionalism Fading?

International stocks posted their strongest first-quarter outperformance against U.S. stocks on record, according to Dow…

Market Drop as Trump Dismisses Auto Tariff Impact

Investors Brace for Market Volatility as Trump Plans Sweeping Tariffs U.S. stock futures dipped on…

Your Guide to Trading Real Money 💰

Hello Traders! Today, I’m thrilled to walk you through my live trading experience using the…

Trump’s Tariff Spark Options Frenzy — Stocks to Watch

Retail investors are bracing for a decisive moment as President Donald Trump’s April 2 tariff…