Nvidia Ascent: Risks of S&P 500 Dominance

In June 2024, Nvidia briefly overtook Microsoft to become the largest company by market capitalization on the S&P 500. While this achievement marks a significant milestone, history shows that holding the top spot often precedes a decline.

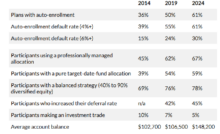

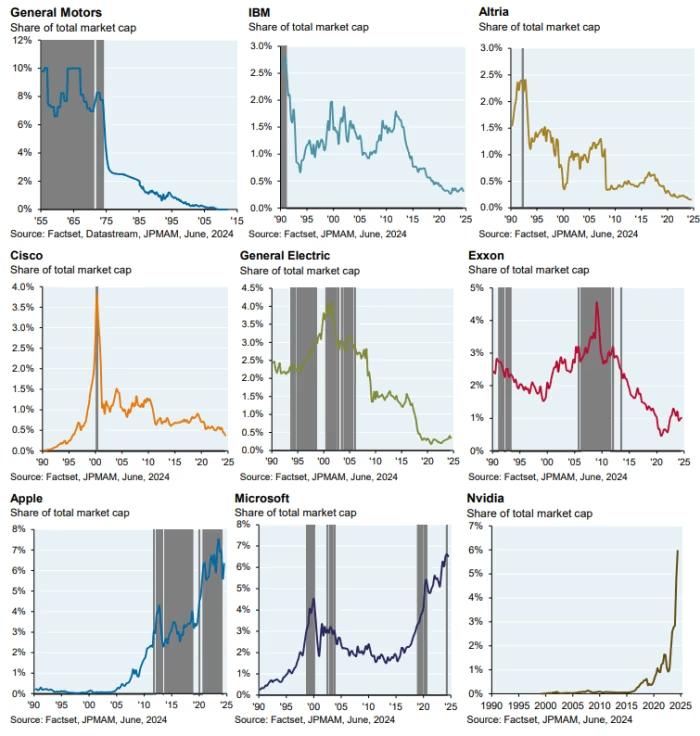

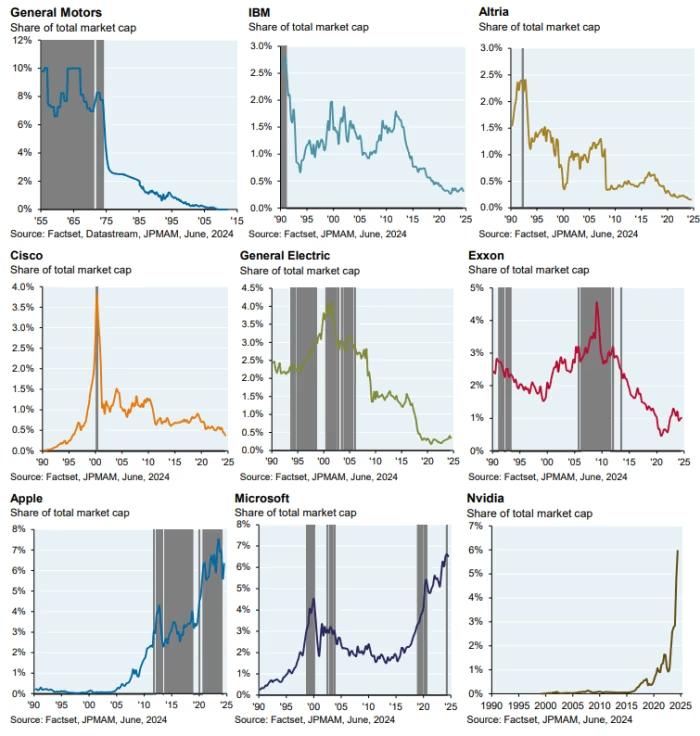

According to JPMorgan Asset Management, many past leaders, including General Motors, IBM, Altria, Cisco, General Electric, and Exxon Mobil, eventually experienced sharp drops in market value after reaching this position.

To date, only Microsoft and Apple have managed to avoid significant declines after becoming the most valuable companies on the S&P 500. Nvidia’s rapid ascent, fueled by excitement over AI technologies, has made it the fastest company to reach the index’s top spot in the post-war era.

The key question now is whether Nvidia will follow the pattern of past market leaders, encountering a downturn, or continue its upward momentum. JPMorgan’s analysts believe that the next 12 to 18 months will be crucial in determining this, depending on whether AI investments yield substantial returns from corporate adoption.

They warn that AI adoption must significantly increase to justify the current levels of investment, drawing comparisons to previous tech booms like the mainframe era and the dot-com bubble.

Despite Nvidia’s strong financial performance, the company faces potential risks from geopolitical tensions and rising competition from rivals like Intel, AMD, and ARM.

Additionally, Taiwan Semiconductor Manufacturing Co., Nvidia’s primary chip supplier, could be a critical factor in its future, especially if tensions between the U.S. and China escalate.

Recent Posts

Good News for Investors Amid Market Turmoil

With market volatility making headlines, discussing retirement optimism might feel out of place. Put Aside…

Sonic Signals Deliver Wins – March 5th

Welcome to our Wednesday, March 5th market recap! Today, we're highlighting how the Sonic Trading…

Nasdaq Nears Correction as S&P 500 Slumps

The S&P 500 benchmark index closed Tuesday at its lowest level since November 4, wiping…

Market Highs: Why Diversification Still Works

Global Investment Returns Yearbook Reveals Profitable Yet Volatile Stock Market A viral clip from Ferris…

Sonic System Strategies for E-mini S&P Trading

Today's market presented a significant downtrend, making it crucial to apply disciplined trading strategies. Using…

Defense Stocks Surge After EU’s Zelensky Meeting Shock

JPMorgan Boosts European Defense Companies' Price Targets by 25% Amid Rising Military Budgets European defense…