Can Higher Yields Trigger a Quick Market Rebound?

Despite rising bond yields putting pressure on U.S. stocks, many analysts remain optimistic about the market future. Nicholas Colas, co-founder of DataTrek Research, expressed confidence in a recent note, saying, “While higher yields are pressuring stocks, we remain bullish.”

Colas views the increase in the 10-year Treasury yield as a sign of continued economic strength, expecting corporate earnings growth to persist in the coming quarters.

Although the S&P 500 fell 1.2% this week, it’s still up 21.5% in 2024, supported by strong earnings and a resilient economy. Andrew Slimmon, senior portfolio manager at Morgan Stanley Investment Management, shared a similar sentiment, acknowledging that the market rally could pause due to higher Treasury yields but will likely pick up again.

He believes that while next year’s returns may be more subdued, the strong economic backdrop will keep the momentum going.

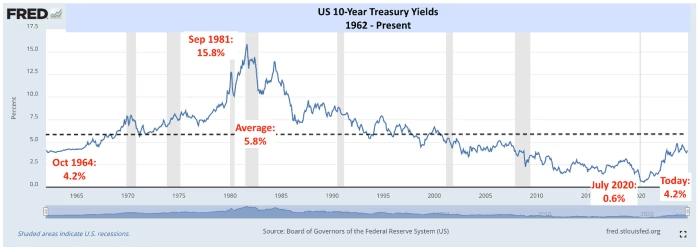

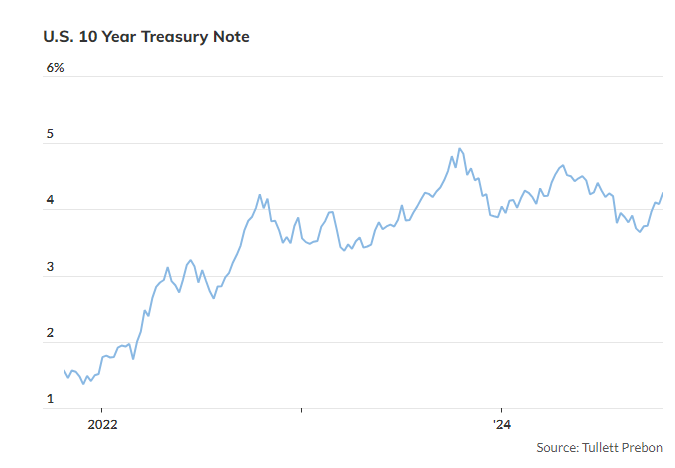

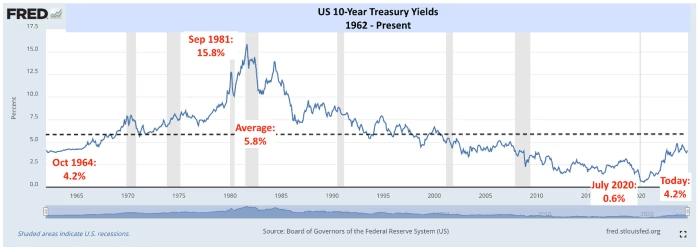

The 10-year Treasury yield climbed to 4.24% on Wednesday, its highest level since July. Colas pointed out that, from a long-term perspective, today’s yields align with historical trends, suggesting the recent rise is not unusual.

Slimmon remains focused on cyclical sectors like financials and industrials, expecting the rally to continue into 2025, even with more moderate gains. While short-term headwinds exist, the overall outlook for U.S. stocks remains positive.

Recent Posts

Apple Shares Slide—What Investors Should Know

Apple Faces Tariff Uncertainty but Has a History of Exemptions Apple’s strong brand loyalty, high…

Beyond Tariffs: More Uncertainty for Investors

Investors anticipating market stability after President Trump’s April 2 tariff deadline may need to prepare…

Global Stocks Outshine U.S. – Exceptionalism Fading?

International stocks posted their strongest first-quarter outperformance against U.S. stocks on record, according to Dow…

Market Drop as Trump Dismisses Auto Tariff Impact

Investors Brace for Market Volatility as Trump Plans Sweeping Tariffs U.S. stock futures dipped on…

Your Guide to Trading Real Money 💰

Hello Traders! Today, I’m thrilled to walk you through my live trading experience using the…

Trump’s Tariff Spark Options Frenzy — Stocks to Watch

Retail investors are bracing for a decisive moment as President Donald Trump’s April 2 tariff…