DayTradeToWin Financial Market News

Trade With Structure — Not Guessing

Get Free Access to the DayTradeToWin Member Software

Join thousands of traders using our proprietary strategies, with precision entries

- All Posts

- DayTradeToWin Review

- Market News

- Site

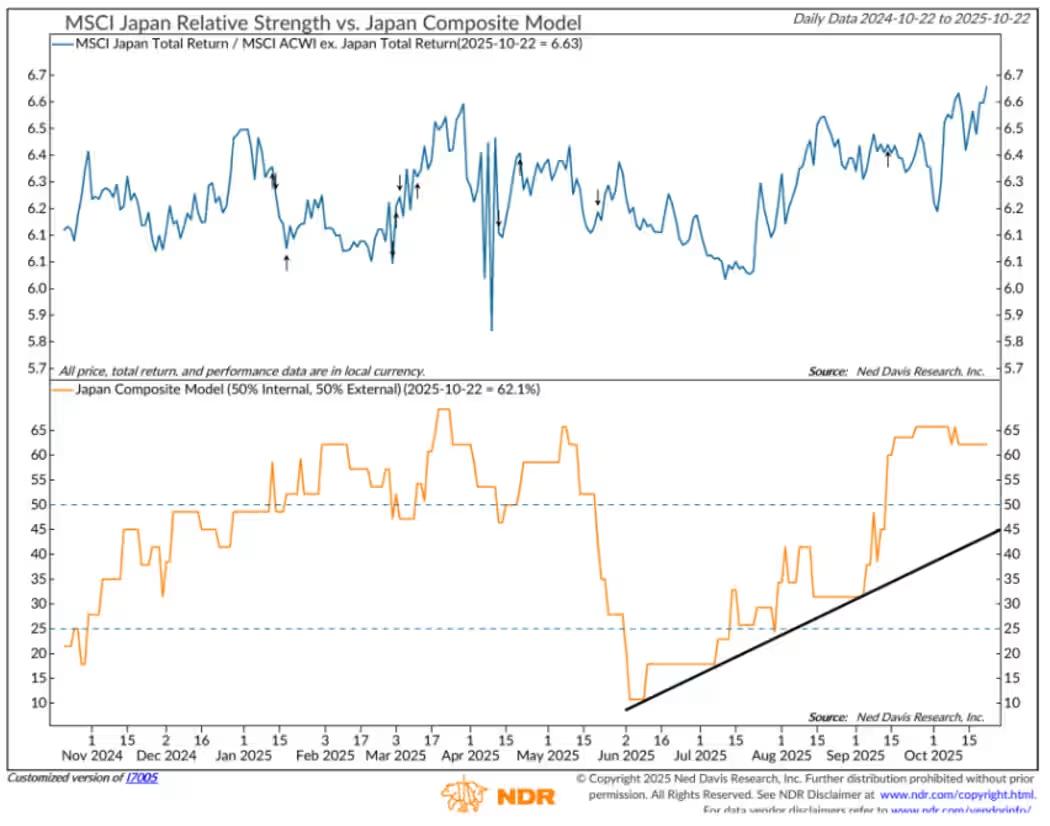

Ned Davis Research: Shift Toward Japan and Emerging Markets, Away from U.S. Stocks The U.S. market may be hitting record...

It’s Thursday, and the E-mini S&P 500 is buzzing with opportunity. Today, let’s break down how you can use Trade...

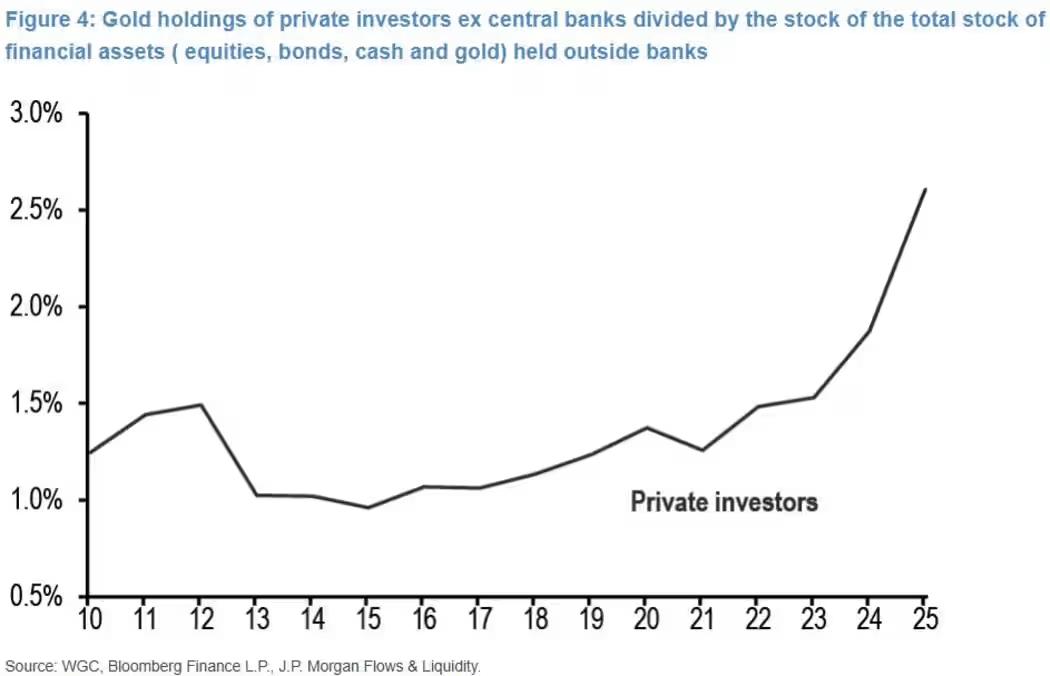

Goldman Sachs Doubles Down on Its Bullish Gold Outlook For those exhausted by the nonstop AI market debate, gold’s dramatic...

David Einhorn’s Greenlight Fund: “We Can’t Make Sense of the AI Math” Just how massive can AI spending get? Meta...

Disney’s Subscriber Cancellations Spike After Jimmy Kimmel Suspension Disney’s latest controversy shows once again that politics and business rarely mix...

It’s Monday, and the markets didn’t disappoint. In today’s session, we’re reviewing how the Sonic System performed from the morning...

Wall Street’s Big Banks Reap the Rewards of a Dealmaking Revival Bank of America (BAC) and Morgan Stanley (MS) delivered...

It’s Friday — a perfect day to talk about one of the most effective tools for precision scalping: the Trade...

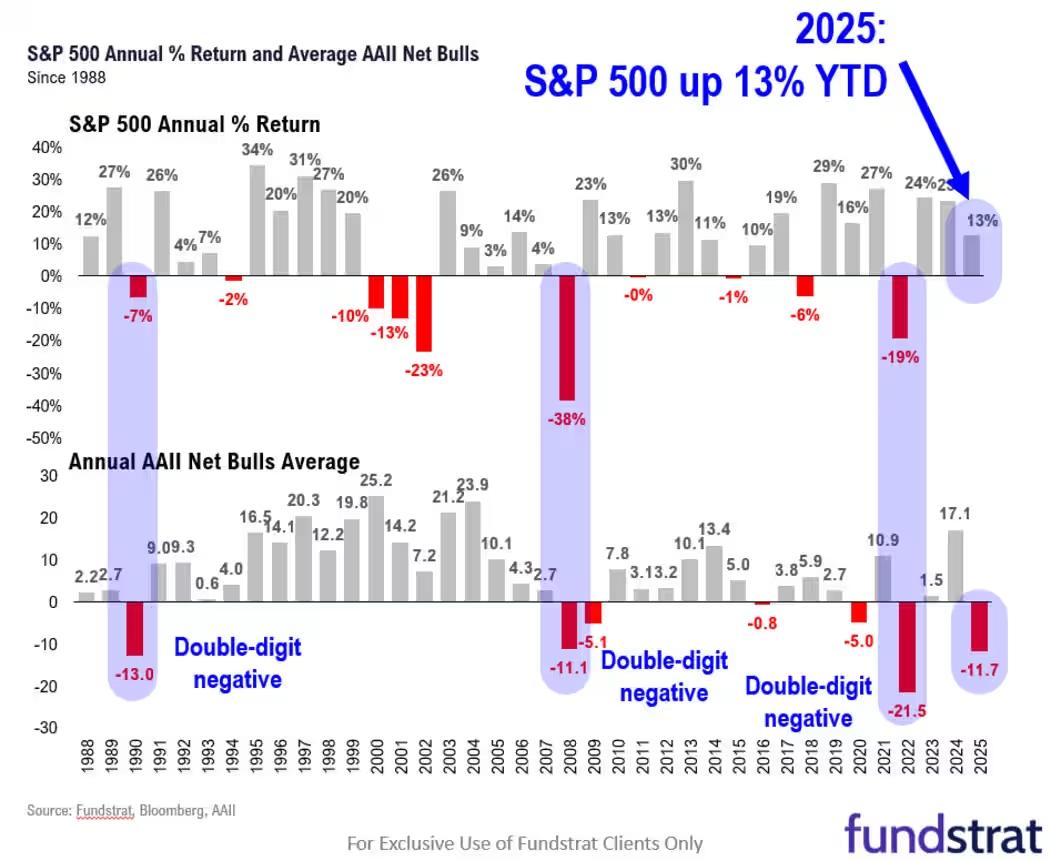

Tom Lee Says Fund Managers’ Year-End Chase Could Drive the S&P 500 to 7,000 Is Wall Street facing a “Cockroach...