Forget CPI: This Markets Signal Warns of Prolonged Inflation

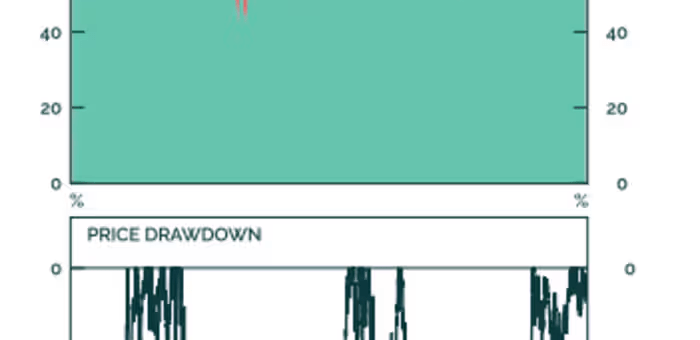

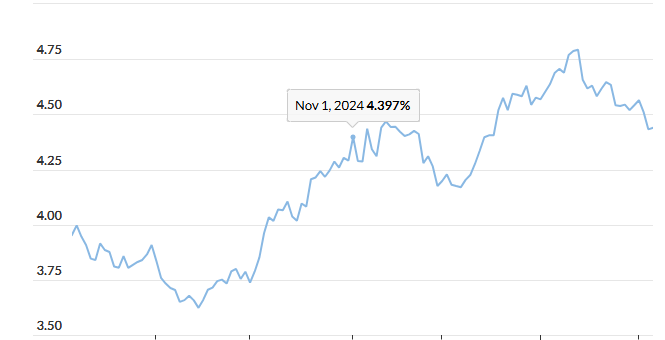

Investors Eye CPI Report as Inflation Concerns Linger As investors brace for January’s consumer price index (CPI) report, financial markets remain on edge over persistent inflation concerns. While expectations suggest little change or a slight improvement from December, one key indicator continues to flash warning signs. The five-year breakeven inflation...