S&P 500 Slumps – Here’s What to Expect

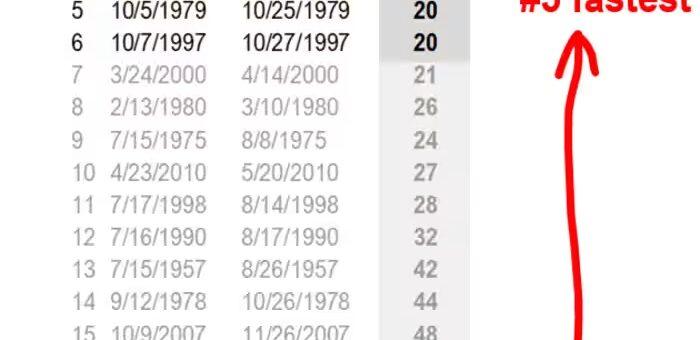

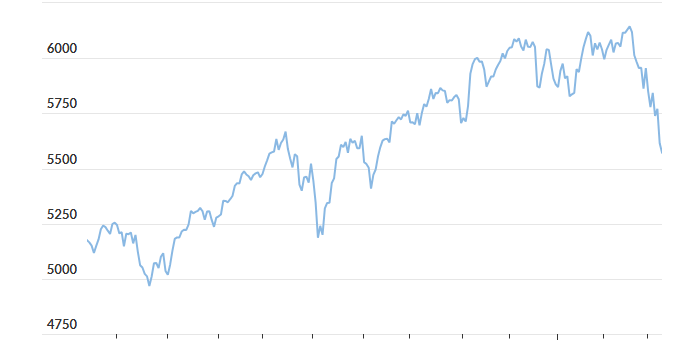

The S&P 500 officially closed in correction territory on Thursday, marking its fastest peak-to-correction decline since March 2020. Another day, another tariff-driven selloff on Wall Street. The U.S. stock market’s sharp decline continued on Thursday, with the S&P 500 dropping 1.4% to close at 5,521.52. The index has now entered...