Anticipating a U.S. Stock Rebound This Week Amidst Ongoing Summer Selloff, Analysts Caution

While there’s a possibility of a short-lived rebound in U.S. stocks this week, experts caution against viewing it as the end of the ongoing late-summer selloff.

Instead, analysts suggest that any potential bounce would likely act as a brief reprieve before the S&P 500 SPX resumes its downward trajectory towards the key support level of 4,200, according to technical analysts.

Various technical strategists have shared research insights with MarketWatch, pointing out that multiple indicators indicate that both the S&P 500 and Nasdaq-100 have entered the territory of being “oversold.”

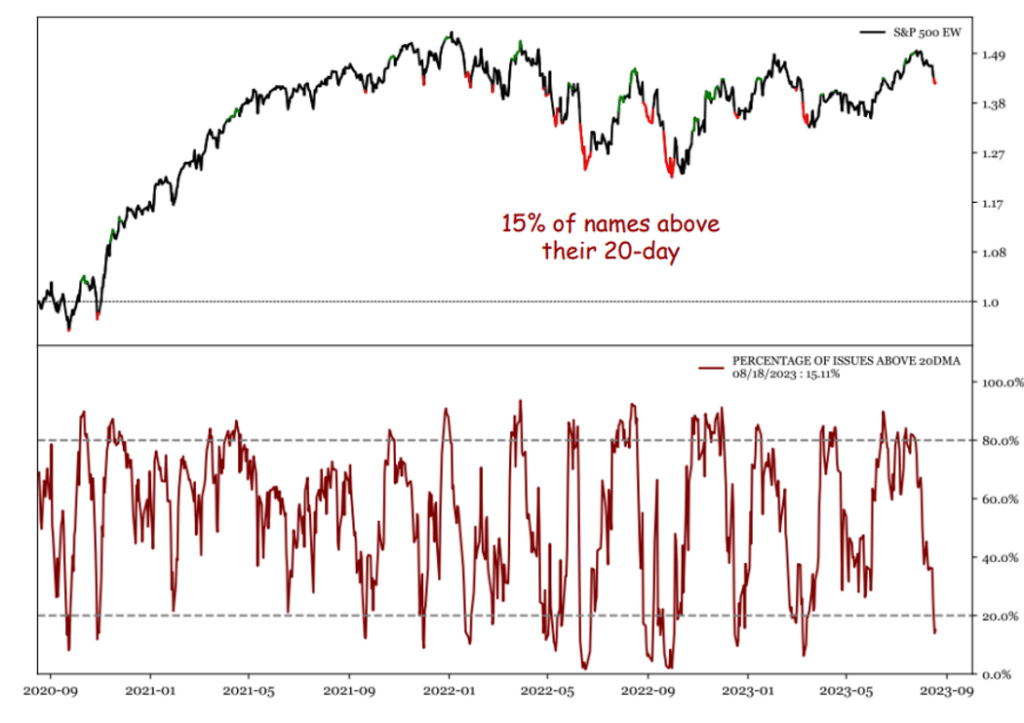

For instance, recent data indicates that only 15% of S&P 500 stocks were trading above their 20-day moving average, a metric highlighted by experts such as Jonathan Krinsky of BTIG and Jeffrey deGraaf from Renaissance Macro. The chart below, courtesy of deGraaf and his team, illustrates this point:

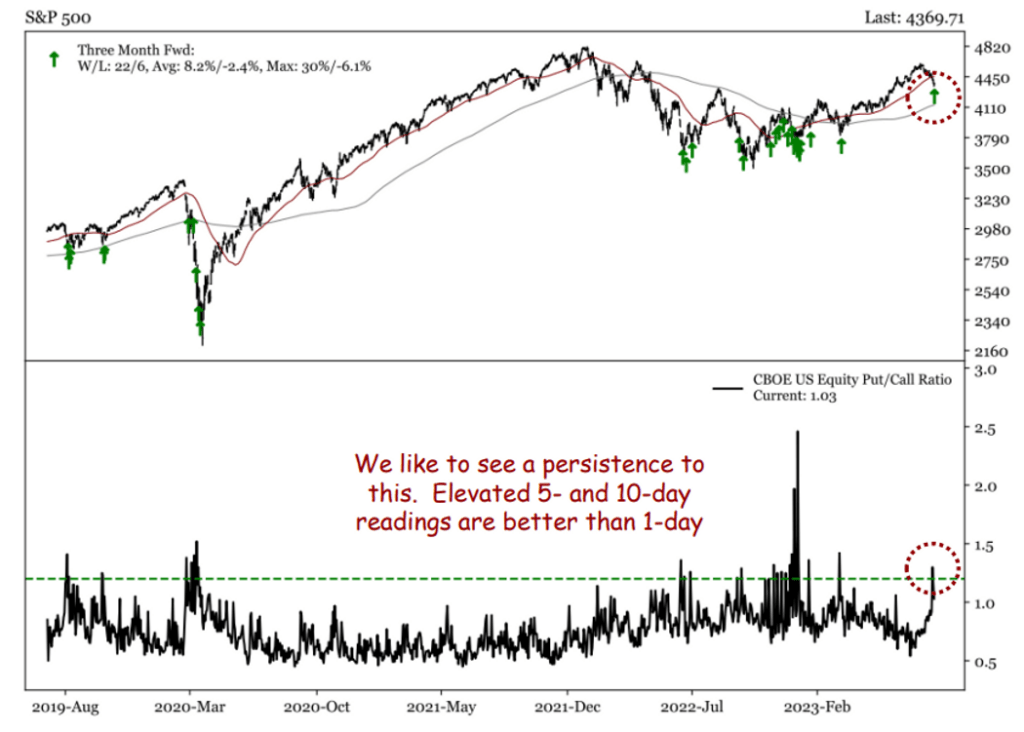

Both Krinsky and deGraaf have pointed to the 10-day U.S. equity put-call ratio, which recently surged to its highest level in 2023. This uptick signifies a heightened preference for put options, which typically yield returns when stock prices decline.

However, Krinsky advised his clients to keep their focus on the bigger picture, suggesting that the ongoing selloff might only be halfway through.

Krinsky projected that any potential rebound might taper off around the 4,450 level, while technical analysts have identified 4,200 on the S&P 500 as a strong long-term support level. Notably, 4,200 had served as a notable resistance point for stocks for over half a year.

“While there are factors suggesting short-term relief, we believe the selloff is only about halfway through,” noted Krinsky.

Others in the market share a similar viewpoint, including Katie Stockton, founder and managing partner of Fairlead Strategies. She predicts that the S&P 500 might stabilize just below 4,200, potentially erasing a significant portion of the year-to-date gains. Data from FactSet reveals that the S&P 500 had risen by nearly 20% for the year at its peak last month.

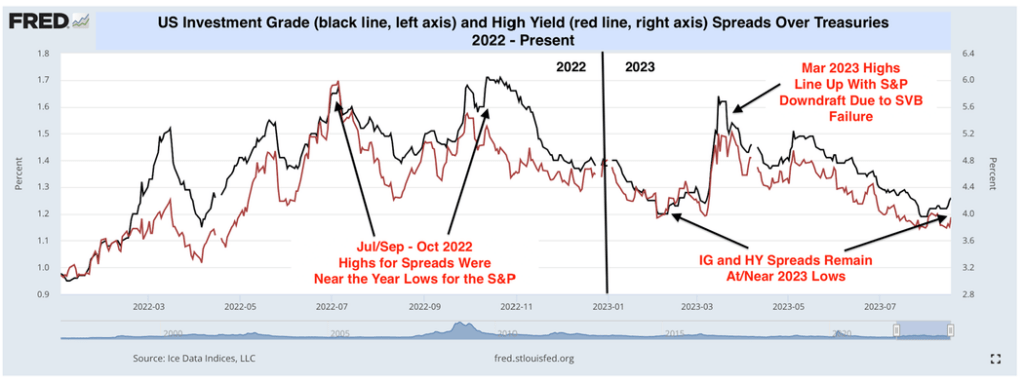

Another noteworthy development is the limited spread between Treasury yields and corporate bond yields. This distinctive aspect distinguishes the current selloff from previous instances when stocks plummeted to their yearly lows, such as in October. Nick Colas of DataTrek highlighted in a recent research note that the spreads for corporate bonds, at 1.26 percentage points over Treasurys for investment-grade corporates and 3.95 points for high-yield bonds, remain “remarkably low.”

This suggests that investors are potentially reassessing equity valuations that many deem to be overextended, based on expectations for corporate earnings.

As of late July, the forward 12-month price-to-earnings ratio for the S&P 500 stood at 19.4, surpassing the five-year average of 18.6 and the 10-year average of 17.4, according to FactSet data. The index’s recent decline has brought it to a more reasonable level of 18.6, aligning with its five-year average.

“The disparity this month must be attributed to something unique to stocks, which is equity valuations,” observed Colas.

While investors remain watchful of corporate bond spreads, concerns are amplified alongside the rise of long-dated Treasury yields. Any sign of their upward movement could indicate bond investors’ apprehensions about rising borrowing costs impacting corporate cash flows and profits.

Despite these uncertainties, U.S. stocks concluded Monday with mostly positive results. The Nasdaq Composite COMP snapped a four-day losing streak, surging by 1.6% to 13,497.59 points. The S&P 500 registered a 0.7% increase to 4,399.77 points. On the other hand, the Dow Jones Industrial Average DJIA experienced a slight decline of 0.1% to 34,463.69 points. Both the S&P 500 and Nasdaq endured three consecutive weeks of decline.

The upcoming week presents an array of potential risks for stocks, including Federal Reserve Chairman Jerome Powell’s speech and an earnings report from market standout Nvidia Corp. NVDA, +8.47%.