DayTradeToWin Reviews Blog

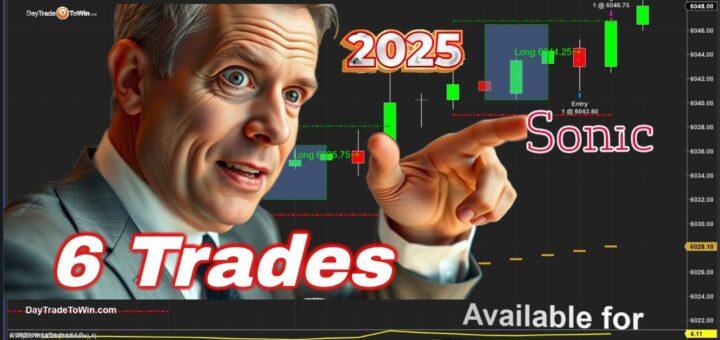

Hello, Traders! Today is February 4th, and I’m excited to share a live trading session using the Sonic Trading System by Day Trade to Win. Before we dive in, remember that trading involves risk—never trade with funds you cannot afford to lose. Navigating Market Open Volatility At 9:30 AM New...

Paul Tudor Jones Warns: “It Will Take a Maestro to Pull This Off” Legendary investor Paul Tudor Jones believes navigating today’s financial markets will require extraordinary skill. Speaking to CNBC on Monday, the billionaire trader—who famously predicted the 1987 stock market crash—warned that the economic landscape is more precarious than...

New Tariffs Surpass First-Term Levels, Escalating Trade Tensions The U.S. will impose sweeping new tariffs starting Tuesday, with a 25% levy on imports from Canada and Mexico and an additional 10% on Chinese goods. The move significantly expands Trump-era trade policies, heightening tensions with key allies and rivals alike. To...

IBM’s AI-Powered Consulting Growth Sparks Market Optimism IBM is making a comeback, and Wall Street is taking notice. Evercore ISI analyst Amit Daryanani sees a bright future for International Business Machines Corp. (IBM), following its latest earnings report. Investor enthusiasm has sent IBM’s stock soaring, making it the top performer...

Meta CEO Calls Consumer AI ‘One of the Most Transformative Products We’ve Made’ Meta Platforms Inc. isn’t backing down from its aggressive spending, even after the DeepSeek news. The company reaffirmed its forecast of $60 billion to $65 billion in capital expenditures for the year—an outlook CEO Mark Zuckerberg first...

Today, we’re bringing you a fresh perspective—a concise market analysis for today and a forecast for 2025. Important Reminder: Trading carries risk. Only trade with capital you can afford to lose. Now, let’s get started! Sonic Trading System Review This morning, we’ve already seen several promising opportunities. We have three...