DayTradeToWin Reviews Blog

U.S. stock futures moved higher Sunday night, building on last week’s rebound when the S&P 500 broke a four-week losing streak. As of 11 p.m. Eastern, futures for the Dow Jones Industrial Average (YM00 +0.75%) were up about 220 points, or 0.5%. S&P 500 futures (ES00 +0.97%) gained 0.6%, while...

Jeffrey Emanuel, the former crypto executive and blogger who made waves earlier this year with his warning about Nvidia vulnerability to Chinese AI startup DeepSeek, is now cautioning investors about CoreWeave’s upcoming IPO. Emanuel’s analysis on DeepSeek led to a $600 billion drop in Nvidia market value in a single...

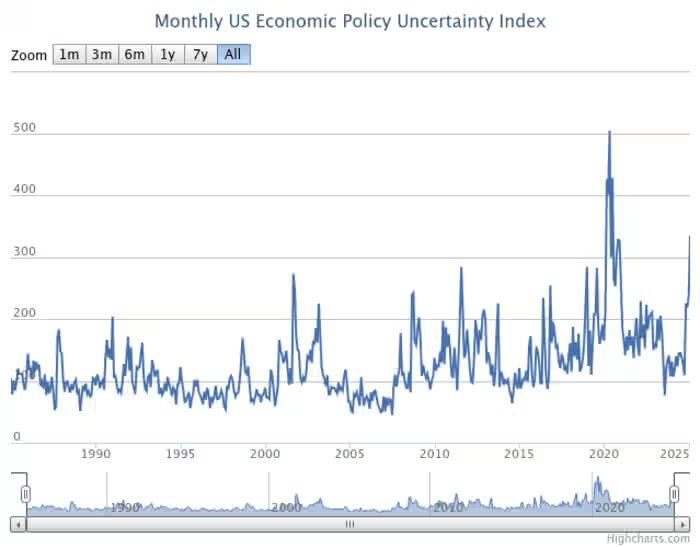

Fed Holds Off on Changes, Maintains Outlook for Two Rate Cuts in 2025 — For Now The Federal Reserve kept interest rates steady on Wednesday and reaffirmed its forecast for two rate cuts in 2025, despite growing economic uncertainty fueled by President Donald Trump’s new tariffs. “Uncertainty today is unusually...

Nvidia’s Keynote Delivered Energy — but Not the Surprise Investors Wanted Jensen Huang took the stage with trademark enthusiasm, speaking for nearly two hours — reportedly without a teleprompter — about Nvidia’s bold future. But for investors hoping for a game-changing announcement, the presentation fell short. Nvidia shares (NVDA) closed...

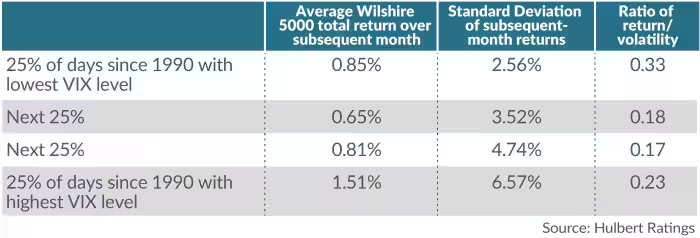

A VIX Spike Can Be Bullish — But Volatility Comes With a Price A surge in the VIX often signals heightened fear — and for contrarians, that can mean opportunity. But while a spiking, it can sometimes precede gains, it also brings sharp market swings that can shake even experienced...

Don’t Count on a ‘Powell Put’ This Week, Economist Warns Investors hoping for Federal Reserve intervention amid market volatility may be out of luck. Fed Chair Jerome Powell is unlikely to signal any support measures when policymakers meet this week, despite recent stock market weakness. “The upside risks to inflation...