DayTradeToWin Reviews Blog

Bespoke: S&P 500’s August Rebound Driven by Broad Market Strength Across Multiple Metrics More U.S. stocks are participating in the ongoing stock market rally, with the S&P 500 extending its August rebound, according to Bespoke Investment Group. “Since the sharp decline that bottomed out on August 5, the market’s recovery...

The U.S. stock market is approaching the high valuation levels last seen at the peak on January 3, 2022. When it recovers from a correction and approaches a new all-time high, it’s essential to compare current valuations with those at previous peaks. Investors often expect these downturns to eliminate prior...

Federal Reserve Chairman Jerome Powell has pledged to take all necessary measures to sustain a strong labor market, vowing to prevent a rise in unemployment that could push the U.S. economy into recession. “We do not seek or welcome further cooling in labor-market conditions,” Powell declared in a speech on...

You might expect the final week of August to be one of the slowest on Wall Street, with traders enjoying the last days of summer before Labor Day. However, a major event is about to capture the market’s attention: Nvidia’s upcoming earnings report. In fact, one money manager suggested that...

Today, I’m thrilled to introduce something new and powerful—the Sonic Trading System. After extensive development and testing, this hybrid trading system is ready to help you make more informed trading decisions with clear signals, precise targets, and well-defined stops. In this post, I’ll walk you through how the Sonic Trading...

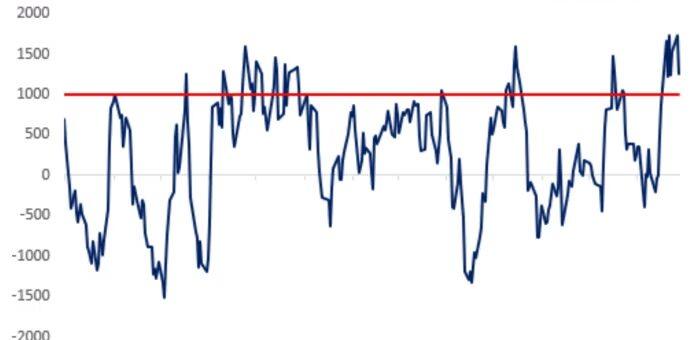

Hedge funds have largely refrained from participating in the recent market rally following the unwinding of the yen carry trade over the past two weeks, according to a new analysis from Goldman Sachs’ prime brokerage division. Despite a strong rebound that has seen the Nasdaq 100 rise by 11% and...