S&P 500 Futures Climb a Rocky Path Amid Global Instability ?️?

At the start of the week, there were small rises in U.S. stock futures, as worries about tensions in the Middle East and the growth of Treasury yields were taken into consideration.

How are stock-index futures trading

- The ES00, which represents the S&P 500 futures, rose by 9 points or 0.2% to reach a level of 4365.

- The futures of the Dow Jones Industrial Average rose by 0.37% or 103 points, resulting in a 0.3% increase to reach 33,929.

- The value of the Nasdaq 100 futures, represented by the ticker symbol NQ00, rose by 15 points or 0.1%, reaching a total of 15136.

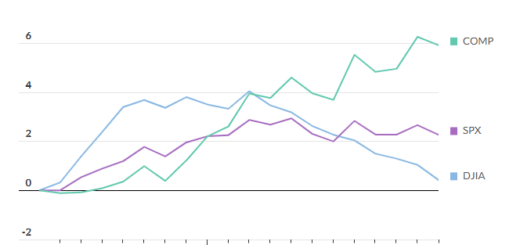

On Friday, the Dow Jones Industrial Average (DJIA) went up by 39 points, representing a 0.12% increase, and reached 33670. The S&P 500 (SPX), on the other hand, dropped by 22 points, which translates to a 0.5% decline, and ended up at 4328. The Nasdaq Composite (COMP) experienced a decrease of 167 points, equivalent to a 1.23% drop, and reached 13407.

What’s driving markets

Equity traders are starting the week with uncertainty and caution as they are concerned about several factors including escalating tensions in the Middle East, oil prices crossing the $90 per barrel mark, higher Treasury yields, and the approaching corporate earnings season for the third quarter.

According to Richard Hunter, who is the head of markets at Interactive Investor, investors are becoming more careful because they have to take into account a greater number of factors.

According to Susannah Streeter, who is responsible for managing money and markets at Hargreaves Lansdown, the current conflict between Israel and Hamas is just another example of a geopolitical divide that, when coupled with the ongoing Ukraine-Russia warfare and the tensions between the United States and China, has the potential to negatively impact global economic progress.

According to Streeter, JPMorgan Chase’s CEO, Jamie Dimon, has voiced worries about the world potentially entering a dangerous phase, overshadowing the bank’s positive financial results released on Friday.

On Tuesday, some more prominent banks located on Wall Street, including Bank of America, Goldman Sachs, and BNY Mellon, are scheduled to make public their financial outcomes. The subsequent day, Wednesday, there will be a disclosure of the earnings of noteworthy technology companies such as Netflix and Tesla.

The U.S. economic updates, including the Empire State manufacturing survey for October, are set to be released on Monday at 8:30 a.m. EST.

The President of the Philadelphia Federal Reserve, Patrick Harker, has two speeches planned: one at 10:30 a.m. and another at 4:30 p.m.

The reference rate for 10-year Treasury bonds, known as BX:TMUBMUSD10Y, rose by around 6 basis points and reached 4.685%. This increase in the yield is an indication of traders being careful because of recent positive economic data in the United States and signs of ongoing inflation, which could mean that interest rates will stay higher for a long time.

Tom Lee, Head of Research at Fundstrat, suggests that investors should exercise caution in light of the current geopolitical circumstances. Nonetheless, he is optimistic about three factors that could potentially yield encouraging outcomes in the stock market.

In a written message over the weekend, Lee mentioned that the decline in the US 10-year yield indicates a favorable direction for stocks.

The second factor is that the likelihood of the Federal Reserve raising interest rates is predicted to decrease from 30% to nothing as they receive new information. “While some worry about the return of inflation, the Federal Reserve has stated that the rise in long-term interest rates is achieving the desired tightening effect,” he clarified.

In the English language, the following paragraph can be paraphrased as: Furthermore, if there is a successful earning season in the third quarter, investment managers who currently have a shortage of $47 billion in U.S. equities are likely to make substantial purchases. Lee pointed out that Goldman Sachs has noticed this trend and predicts that a rising market will attract even more buyers.