Maximizing Profit with Sonic on TradingView & NinjaTrader

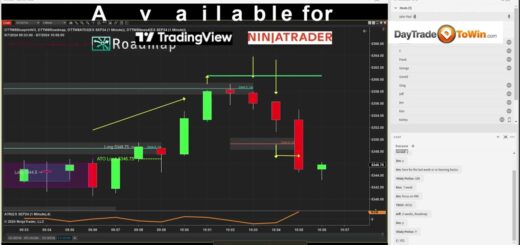

Hello, Traders! Today, we’re exploring the Sonic trading system on two of the most popular trading platforms—TradingView and NinjaTrader. Whether you’re currently using one or both, this comparison will help you understand how each platform handles Sonic’s powerful signals and settings.

Why Compare TradingView and NinjaTrader for Sonic?

- Platform Accessibility: TradingView is known for its flexibility—it’s accessible via web, Mac, or PC, which appeals to a broad range of traders. NinjaTrader, however, is often favored by funded account traders who appreciate its established reliability and features specific to pro-level trading.

- Consistent Signals: Both platforms provide identical signals with Sonic. For example, if the system shows a short entry at 5865.50 on TradingView, NinjaTrader will show the same, with synchronized stops and ATR-based targets for consistency across trades.

Setting Targets and Stops

The Sonic system uses the Average True Range (ATR) to calculate targets on both platforms, allowing you to set targets at 1x, 2x, or even 0.5x the ATR based on your trading goals. Stops are placed just a few ticks above or below a shaded box on the chart—a visual guide that helps keep risk levels in check.

Sonic System Features on Each Platform

NinjaTrader

NinjaTrader offers audio alerts for signals, ATR-based targets, and a five-tick stop above or below the shaded box. Customizing chart colors and styles is straightforward, letting you set up visuals that match your preference. Additionally, NinjaTrader is compatible with Apex and other funded accounts, since it doesn’t rely on automated trading bots.

TradingView

On TradingView, you get a similar range of options, with the ability to adjust colors, text size, and signal settings. Custom alerts help you stay on top of signals, and a built-in trend filter guides you to trade in the direction of the current market trend, only showing short or long entries depending on price movement.

Key Tips for Trading with Sonic

- Manage Your Trade Count: The Sonic system can generate multiple signals, but taking every trade can lead to overtrading. Generally, aiming for 3-5 quality trades a day, especially if you’ve reached a $200–$300 profit, helps in avoiding unnecessary losses.

- Improve Entry Quality: If the target and stop don’t align well, it’s okay to pass on the trade. If a better price entry is possible, consider it for a more favorable risk-to-reward ratio.

Sonic System Configuration: Customizing Your Settings

In both platforms, the Sonic system uses dual alerts that you can activate or deactivate independently. Customizing the colors, styles, and text sizes can enhance your overall trading experience by creating a setup that best suits your trading style and strategies.

How to Get Started with Sonic

Interested in trying Sonic? You can subscribe for a yearly plan or invest in a lifetime license. DayTradeToWin also offers an accelerated mentorship program, which bundles the Sonic system with other trading tools and live trading room access, giving you hands-on experience with Sonic in real-time.

To learn more or try a free member account with trial access, visit daytradetowin.com. Join today and start exploring a price-action-focused approach to trading.