DayTradeToWin Reviews Blog

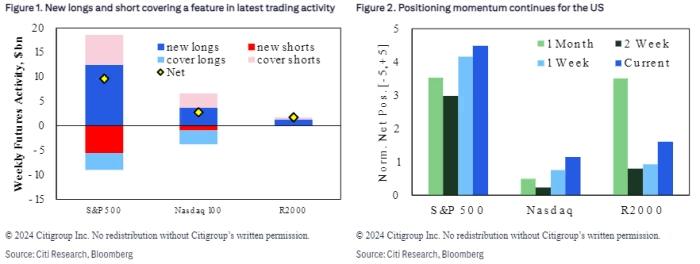

Citigroup strategists are growing concerned about the current bullish sentiment in the stock market but aren’t advising investors to reduce their positions yet. Chris Montagu, Citigroup’s global head of quantitative research, noted that net-long positioning in S&P 500 futures has reached its highest level since July 2023. At that time,...

Today, we’re diving back into the Sonic Trading System, following up on yesterday’s session where we executed five trades consecutively. Our goal today is to build on that momentum, analyzing market activity from the opening bell and tracking trades throughout the day. Trading carries significant risk, and it’s important to...

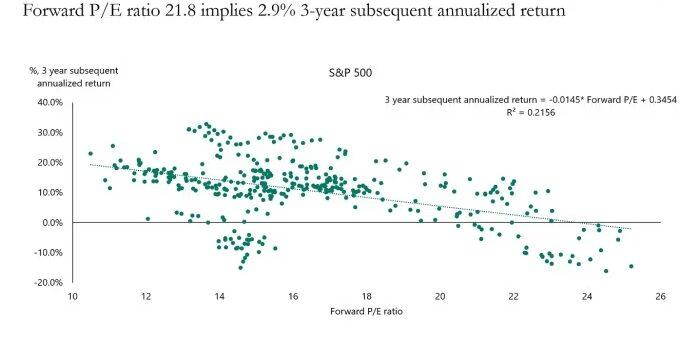

A report from David Kostin, chief U.S. equity strategist at Goldman Sachs, recently added fuel to this discussion. Kostin cautioned that the S&P 500 could be heading for one of its weakest stretches of returns in nearly a century. His warning echoed earlier concerns from strategists at J.P. Morgan and...

Hello Traders! Today is Monday, October 21st, and I’m excited to dive into the Sonic Trading System with you. I’ll be walking you through the first five trades of the day, showing the results in real-time to give you a clear picture of how the Sonic system performs in both...

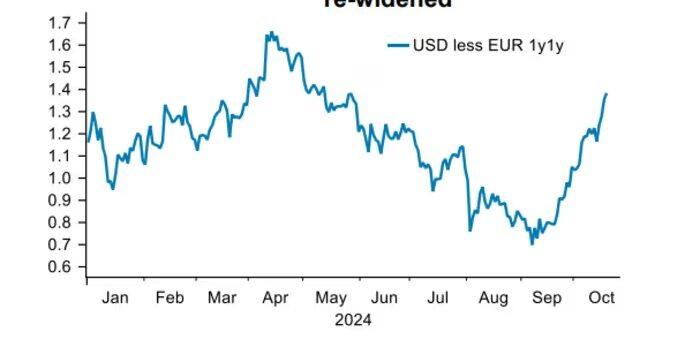

BNP Paribas and UBS Global Wealth Management Highlight U.S. Economy’s Resilience The U.S. economy is once again in the spotlight, with The Economist calling it the envy of the world in a recent cover story. While some, like Brett Donnelly from Spectra Markets, have noted that such magazine covers often...

The Dow Jones Industrial Average’s performance as a predictor of U.S. presidential election outcomes warrants serious consideration. There is a strong correlation between the Dow’s year-to-date return through mid-October and the chances of the incumbent party winning the presidency. This relationship is statistically significant at a 97% confidence level. Currently,...