S&P Hits 6,000, Dow Breaks 44,000 — What’s Next?

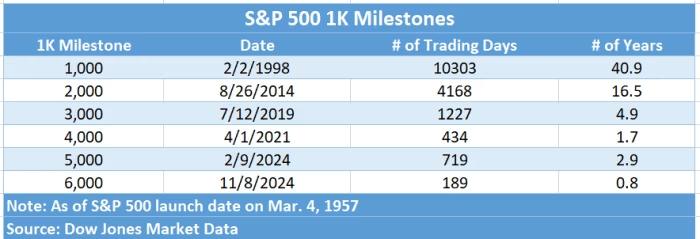

Tony Roth, Chief Investment Officer at Wilmington Trust, projects that the S&P 500 could climb into the mid-6,000s over the next two months, as recent market optimism shows no signs of slowing. On Monday, the S&P 500 closed above 6,000, while the Dow Jones Industrial Average topped 44,000 for the...