Exploring the Untapped Potential: The Forgotten Part of the Stock Market

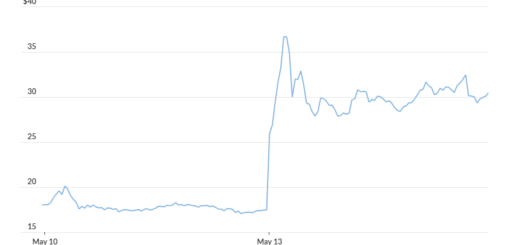

As mentioned before, stock prices have risen more broadly, with small-cap stocks doing particularly well following a mixed jobs report on June 2 that allowed the Federal Reserve to avoid increasing short-term interest rates last week. Midcap stocks, which have not received much attention in the past, are also experiencing a resurgence. Until the end of May, midcap stocks, as measured by the Russell MidCap index, had a slightly positive total return for the year so far, while the S&P 500 had increased by nearly 10%. Since the start of June, the Russell MidCap has increased by over 6.7%, compared to the S&P 500’s 5.5%.

Midcap stocks occupy a middle ground in terms of the size of their market capitalization, positioned between large corporations and those with smaller market values. The Russell index guidelines dictate that the top 200 firms in terms of market capitalization fall under the mega-cap index, while the next 800 belong to the Russell MidCap index. The Russell 1000 index combines these two to create a comprehensive list that is commonly known. The remaining 2000 smaller companies are included in the Russell 2000 index.

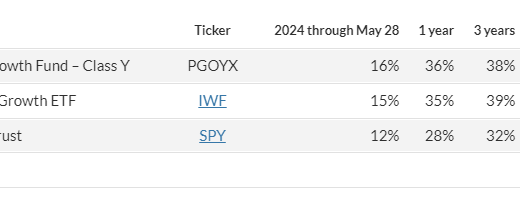

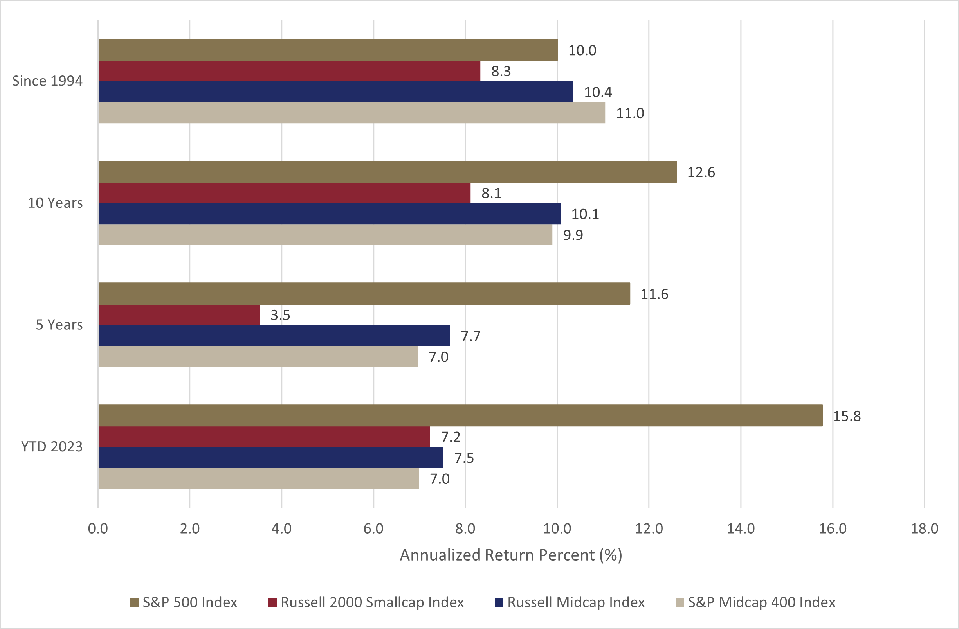

Despite their recent success, midcap stocks have not performed as well as the S&P 500 this year. Nonetheless, it is important to note that midcap stocks have actually done better than small-cap stocks in the past five, ten, and even since 1994. While midcap stocks have fallen short in comparison to large-cap stocks in the last five and ten years, they have consistently outperformed them over a longer period of time.

The adage states that past achievements don’t guarantee future success. Therefore, what factors could lead midcap stocks to outperform their past performance? A possible rationale is that midcap firms tend to be more robust and reliable enterprises compared to small-cap stocks. The Russell 2000 index has over 42% of its constituents not making any profit. Typically, these midcap stocks have risen from the small-cap niche of the market, and now the unprofitable firms are typically weeded out.

Those who analyze the stock market usually pay more attention to very large companies, and these companies are usually considered more valuable than smaller or less familiar ones. Companies of medium size (referred to as midcaps) have the ability to benefit from cost savings due to their size and offering a wide range of products, but they also have potential for expansion. Surprisingly, some well-known companies such as Lululemon Athletica, Yum! Brands, and Clorox are classified as midcaps. As a result, it can be argued that midcaps present the perfect potential for investment.

In conclusion, judging by the comparison of midcap stocks with large-cap stocks, midcap stocks are expected to do well. Based on projections for earnings in 2023, midcap stocks are valued at 14.5 times their actual worth, whereas the S&P 500 is valued at 19.9 times its worth. This indicates that the gap in value is almost identical to that during the dot-com boom of the late 1990s. Midcaps had a remarkable track record of achievement throughout this period.

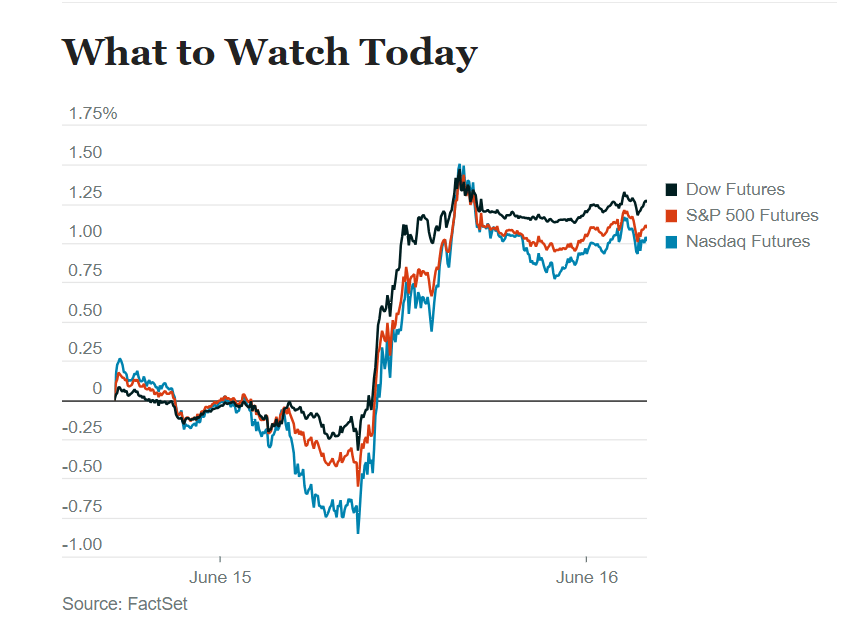

The previous week, Federal Reserve Chair Powell ceased raising rates according to his preference. Nevertheless, the Fed believes that short-term interest rates should rise by 25 basis points (0.25%) twice in 2023. The market assumes that the Fed will raise short-term interest rates once during the July meeting. While the forecasted Fed funds rate may increase after the meeting, the bond market anticipates that the Fed will lower rates within a year. The halt in rate increases and the enhanced likelihood of avoiding a recession may contribute to the sustained prosperity of midcap stocks.

Mid-sized company stocks have been more successful than the S&P 500 over an extended period. Currently, their relative worth shows that it is more beneficial to invest in them. Even though assessing value is not a reliable tactic for determining timing, it does imply that mid-sized company stocks are a worthwhile long-term investment. While the market’s overall performance is diverse, recent trends suggest that mid-sized company stocks may continue to thrive. Investors should either take an involved approach when investing in this sector, or purchase the iShares Russell Mid-Cap ETF (IWR) which is economical and has tax advantages.