Walking the Tightrope: How Tech Stocks’ Downturn Could Shake 2023’s Stock-Market Rally

The Nasdaq-100, being the leading performer among key U.S. stock indices this year, has just encountered its toughest two-week period since December, according to data from Dow Jones Market.

On Friday, the tech-focused index ended a fortnight slide of 4.6%, dropping 100.77 points or 0.7%, to close at 15,028. This signifies the most significant loss since December 23 when the index witnessed a 5% retreat, according to Dow Jones Market Data.

The latest information indicates a dip in the usually robust market momentum of surging technology stocks. According to a report from Wednesday, the widely tracked Invesco QQQ Trust Series 1 QQQ exchange-traded fund on the Nasdaq-100 index, for the first time since March 10, concluded below its 50-day moving average, as shown by FactSet data. The index has consistently finished below its moving average for three consecutive sessions. Technical analysts interpret this as a possible sign of the index’s gains in 2023 continuing to dwindle.

Approximately 40% of the Nasdaq-100’s worth is composed of a handful of highly valuable large tech stocks. The diminishing strength of a number of these important stocks, which played a major role in the U.S. market’s rebound in 2023, is amplifying fears that the market may be edging towards a more substantial and possibly widespread sell-off.

The shares of four prominent firms, referred to as the “Magnificent Seven” – Apple Inc., Nvidia Corp., Microsoft Corp., and Tesla Inc., all concluded the week below their 50-day moving averages.

Experts infer that signs of a growing technology rundown may be subtly concealed within the market’s structure.

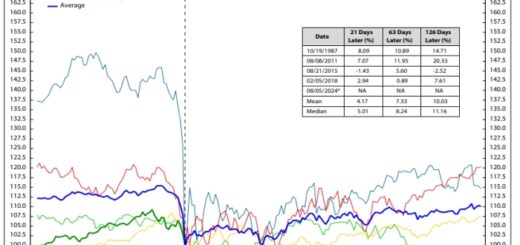

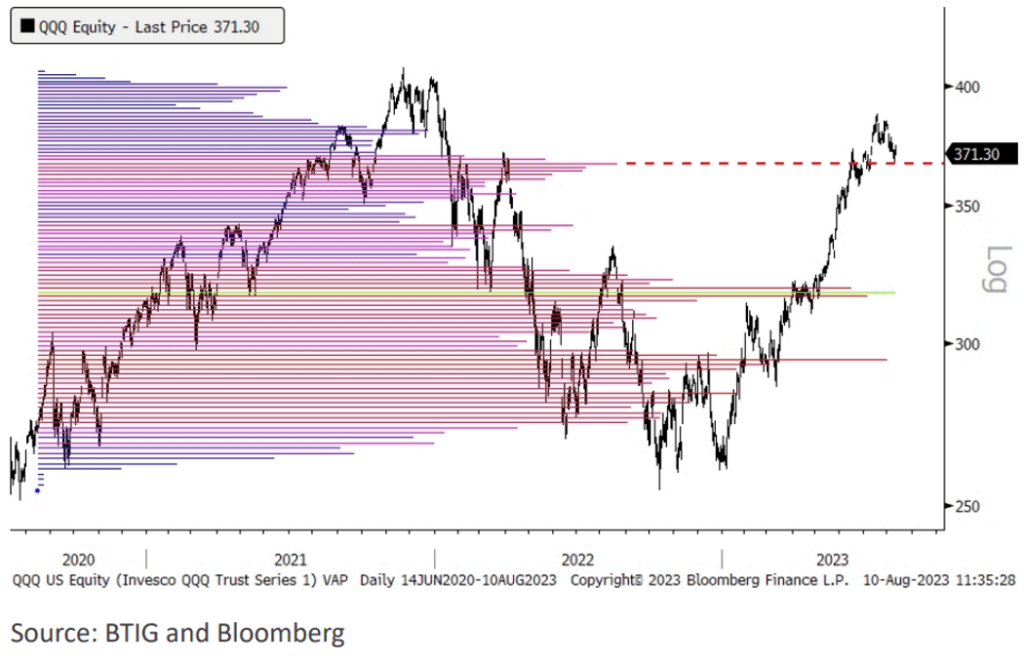

BTIG’s chief technical analyst, Jonathan Krinsky, issued a research note to clients and the media on Thursday. In this note, he suggested that QQQ, along with several other tech-based ETFs, is coming close to a “volume pocket.” This implies these ETFs may face a swift decline in their value.

A review of the volume-at-price data over the last three years indicates that a sustained decrease below $368 for QQQ might lead to its quicker liquidation. This prediction relies on previous volume-at-price analysis, a tool used by stock market specialists to find possible areas of support and resistance for a certain security.

Krinsky conducted an examination of the trade volume of a particular security at diverse price levels within a set time period, utilizing the volume-at-price assessment. His investigation encompassed data from the last three years.

In a phone interview with MarketWatch, Krinsky revealed that support and resistance mechanisms are dependent on the historical values of prices. He went on to explain that due to the participants’ incomplete memory of price ranges within these confines, there can be a faster rate of price fluctuations, Krinsky further discussed.

Krinsky highlighted that QQQ experienced a roughly 16% increase over a period of six weeks from the end of April to mid-June. This substantial growth implies the risk of a potentially faster decline. As of the market close on Friday, QQQ has observed a 37.5% growth since the beginning of the year, a fact supported by FactSet data.

Analysts have credited various factors for the retreat, including over-focused investment, overvalued high-performing stocks, rising treasury yields, and corporate earnings that failed to meet the lofty expectations of investors.

Rising Treasury yields have heightened the stress on stocks, especially on high-performing tech stocks which are significantly vulnerable to fluctuations in interest rates.

The main worry currently is whether the ongoing deterioration of Big Tech will pull the broader market down with it, or if other market segments will step up to offset this deficit.

Here’s the thing: The significant recalibration that happened on Monday led to four major changes in the Nasdaq 100.

James St. Aubin, the main investment director at Sierra Investment Management, indicated that it seems investors are content to divert their attention to other areas of the market that are not as significantly valued as the large tech companies.

St. Aubin informed MarketWatch during a phone discussion that the leading participants are seeing a reduction in their lead, but the ones lagging behind are starting to close the gap. He added that it would be more concerning if funds were consistently being withdrawn and being reinvested in cash and bonds.

U.S. stocks saw a minor uptick on Thursday, but couldn’t hold onto the majority of their early gains. The market got a lift initially when the July inflation data came out, matching economists’ forecasts. However, the President of the San Francisco Fed, Mary Daly, asserted that considerable efforts are still needed from the Fed to manage inflation. This resulted in higher Treasury yields, which caused a swift turnaround in the stock market.

The S&P 500 SPX ended the day with a fall on Friday, marking a reduction of 4.78 points or 0.1%, finishing at 4,464.05. This signals the second week in a row of decreasing performance. The Nasdaq Composite COMP, which includes a broader selection of stocks than the Nasdaq-100, also experienced a descent of 93.14 points or 0.7%, concluding the day at 13,644.85.

The Dow Jones Industrial Average (DJIA) experienced a positive growth, rising by 105.25 points, an increase of 0.3%, to reach 35,281.40.

The 10-year Treasury yield BX:TMUBMUSD10Y experienced a significant increase last Friday, rising to 4.156%, its peak for the week, as shown by data from Dow Jones Market.