Red Flags: S&P 500’s Imminent Reach of 5,000 Suggests Vulnerability

Leuthold Group’s Chief Investment Officer (CIO), Doug Ramsey, observes a troubling trend in market analysis: an increasing number of analysts are disregarding valuations in their assessments. Ramsey notes that this trend isn’t confined to bullish perspectives; even those exercising caution about the market are overlooking the issue of persistently high equity valuations.

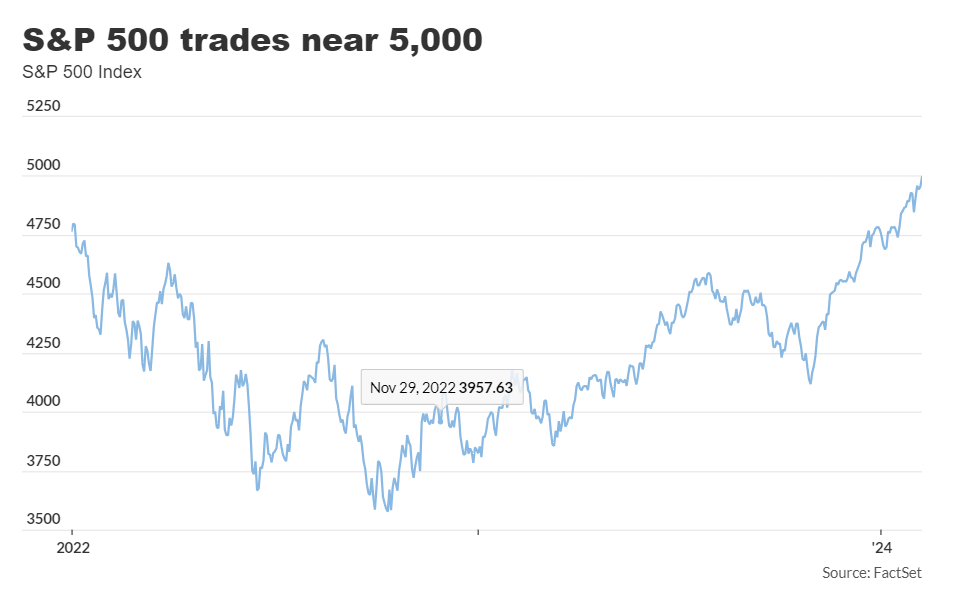

Ramsey’s observations coincide with the U.S. stock market approaching significant milestones, with the S&P 500 index nearing the 5,000 mark. Despite this, Ramsey cautions about the market’s vulnerability to accidents due to its inflated valuations.

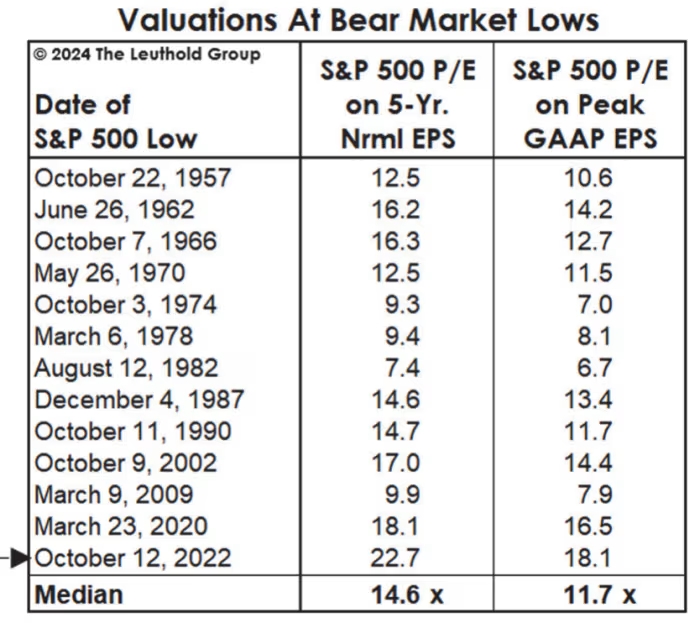

The ongoing bull market, which commenced after the record high in January 2022, has witnessed a steady ascent of the S&P 500. However, according to Leuthold’s analysis, the market’s low point in October 2022 marked a historically expensive phase, laying the groundwork for the current scenario of high valuations.

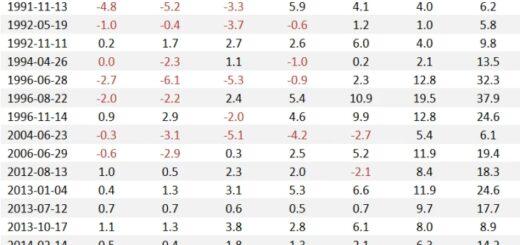

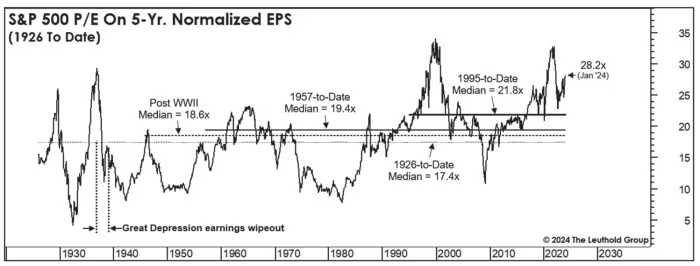

Ramsey underscores critical metrics to illustrate the extent of overvaluation, including the five-year normalized price-to-earnings ratio, which has seen a substantial increase. Similarly, Bob Doll, CEO and CIO of Crossmark Global Investments, echoes concerns about stretched valuations, particularly concerning forward earnings estimates.

Despite widespread optimism about a smooth economic trajectory, concerns linger regarding the Federal Reserve’s ability to balance inflation and interest rates. Doll argues that simultaneously achieving double-digit earnings growth and significant rate cuts is unrealistic, suggesting that the market may be overly optimistic about the Fed’s monetary policy.

Traders’ expectations of multiple rate cuts contrast with Doll’s view that such aggressive easing would necessitate a significant economic slowdown, which seems improbable given the current robustness of the U.S. labor market.

Looking ahead, Ramsey emphasizes the importance of considering the potential for market downturns, especially considering past instances where significant declines occurred despite limited periods of recession.

The market’s performance this year has been buoyed by gains in prominent technology stocks, particularly those involved in artificial intelligence (AI). However, Doll warns against excessive optimism in the AI sector, advocating for a cautious approach and highlighting the importance of considering valuations.

In summary, while the market continues its upward trajectory, concerns about high valuations and the sustainability of current growth patterns persist among analysts like Ramsey and Doll, emphasizing the need for careful evaluation and risk management.