Record-Breaking Moment: Dow Jones Surpasses 40,000, Fails to Maintain

Hold on to your hats. The Dow Jones Industrial Average briefly traded above 40,000 for the first time ever on Thursday but ended the day shy of a milestone that investors said could further boost bullish spirits on Wall Street.

“Breaking the 40,000 barrier is a big psychological boost for the bulls, as round numbers hold special significance in people’s hearts and minds,” Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, said in emailed comments.

The Dow closed the day near 39,869, a loss of around 39 points, or 0.1%, after hitting a session high of 40,051.05 around 11 a.m. Eastern time.

Big, round-number milestones can attract attention to a market rally. Indeed, it’s hard to overstate the hype that accompanied the Dow’s first-ever push above the 10,000 level on March 29, 1999. The move spawned a cottage industry in commemorative merchandise, particularly hats emblazoned with “Dow 10,000” that can still be found on eBay.

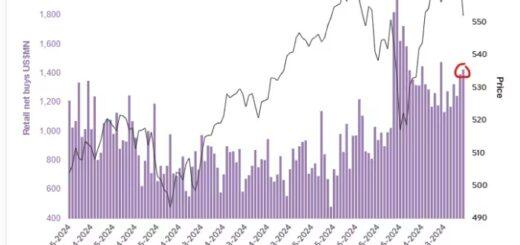

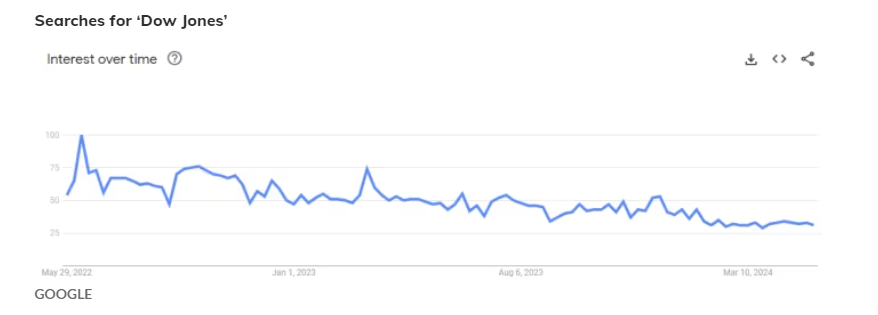

The prospective Dow 40,000 milestone, however, isn’t prompting Americans to party like it’s 1999. Public interest in the record stock-market rally appears tepid at best, analysts have noted.

The Dow, dating back to 1896, remains the measuring stick of the U.S. stock market among the general public, although investment professionals view the S&P 500, launched in 1957, as the true large-cap benchmark.

Searches for “Dow Jones” on Google have trended consistently lower since peaking in June 2022, which marked an initial low in that year’s brutal selloff, observed Nicholas Colas, co-founder of DataTrek Research, in a note last week.

The peak in searches came as the Federal Reserve was preparing to launch a series of outsized interest-rate increases. As stocks sank amid rising recession fears, the American public took notice, Colas said. Since then, interest has trailed off even as stocks have returned to record territory.

“To the degree to which Americans think the stock market is a sign of general economic health, they are not seeing what could be considered an upbeat message,” he wrote. “The idea that stock prices are a transmission mechanism between markets and consumers only seems to work in one direction.”

For investors, meanwhile, there may be little to glean from such advances in themselves.

“I think, if anything, it’s more nostalgic and symbolic than it is a meaningful tell for a professional investor,” Eric Freedman, chief investment officer at U.S. Bank Wealth Management, said in a phone interview in March, when the Dow came within a whisker of the 40,000 threshold but failed to surpass it.

The Dow’s attempted push above 40,000 comes amid a broader rally that saw the blue-chip gauge, the S&P 500, and the Nasdaq Composite all close at record highs on Wednesday.

The S&P 500 cleared a big milestone of its own earlier this year, topping the 5,000 level for the first time. Historic advances for the S&P 500 tend to garner less attention than those for the Dow, even though the S&P 500 is far more relevant, representing a much bigger portion of the investable U.S. stock market.

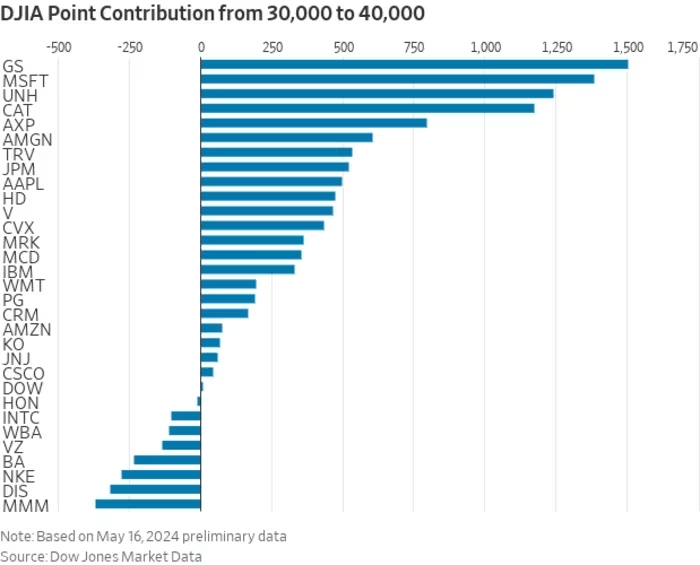

The Dow ended above the 30,000 milestone for the first time on Nov. 24, 2020, after stocks roared back from the pandemic bear market seen earlier in the year.

Including Thursday, it’s been 873 trading days since the Dow first ended above 30,000, according to Dow Jones Market Data. It took the blue-chip gauge 966 days to clear the 30,000 milestone after first closing above 20,000 on Jan. 25, 2017.

Of course, each successive milestone is less impressive in percentage terms. The move from 30,000 to 40,000 represents a 33.3% gain. It took a 4,486 trading-day journey for the blue-chip gauge to double from 10,000 to 20,000.

While 10,000-point milestones aren’t frequent occasions, it’s easy to see why the first push above 10,000 seemed special. It took over a century—28,313 trading days to be exact—for the gauge to enter five-digit territory.

Meanwhile, public indifference to the 40,000 milestone may carry at least one bullish, contrarian implication for the market, said DataTrek’s Colas: “No one can accuse the recent U.S. equity market rally of being fueled by rampant interest in stocks. This is not the 1990s. Not even close.”