Outperforming the S&P 500: The Stock Fund Betting on AI Enablers

Putnam Large Cap Growth Fund’s Strategy for Durable Growth

Investors often demand superior performance to justify higher fees for active management. While outperforming broad stock indexes is challenging and fees can contribute to underperformance, active management can employ strategies to mitigate long-term risk, even with an aggressive growth focus.

The $10.6 billion Putnam Large Cap Growth Fund (PGOYX) showcases successful active management. Co-managed by Richard Bodzy since August 2017 and Greg McCullough since May 2019, this five-star Morningstar-rated fund targets companies with durable business models aligned with industry-wide themes. They invest in “enablers” – companies providing essential tools or services for innovators, ensuring long-term benefits regardless of economic conditions.

Enabler Companies

The fund’s top holdings include Microsoft Corp. (MSFT) and Nvidia Corp. (NVDA). Both are integral across industries, with Microsoft excelling in cloud applications and corporate services, and Nvidia leading in the GPU market for AI technologies. These giants reflect the fund’s strategy of investing in companies with diverse, durable growth opportunities.

Key Examples

- Microsoft: Benefiting from trends in AI, software, and increased screen time, with rising recurring revenue.

- Nvidia: Despite a tripling stock price, its forward P/E ratio has decreased due to rapid earnings growth driven by AI-related spending.

- Cadence Design Systems Inc. (CDNS): Provides essential tools for chip design, sharing a market duopoly with Synopsys Inc. (SNPS).

- Lonza Group AG (LZAGY): Major player in personalized medicine, focusing on manufacturing for biotech, rather than investing in specific therapies.

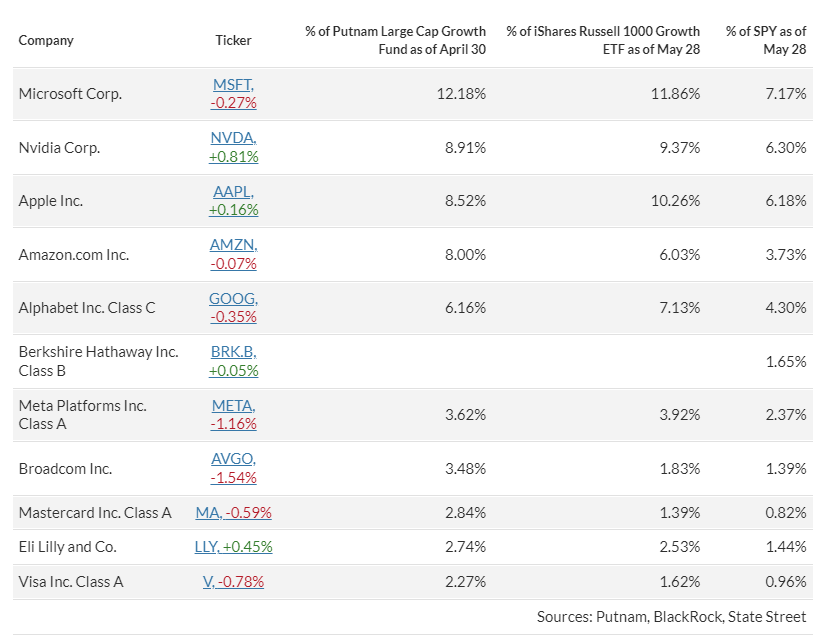

Top Holdings (as of April 30)

Here are the top 10 holdings of the Putnam Large Cap Growth Fund, along with their allocations in the fund, the iShares Russell 1000 Growth ETF (IWF), and the SPDR S&P 500 ETF Trust (SPY).

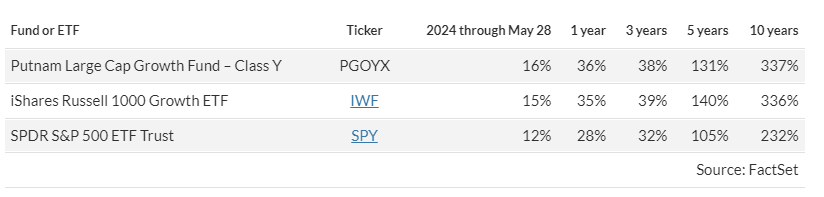

Performance

The Putnam Large Cap Growth Fund’s Class Y shares, available to institutions or via investment advisers, have outperformed the S&P 500 over the long term despite higher fees. Bodzy and McCullough emphasize investing in innovative, structurally advantaged companies to guard against uncertainty, positioning the fund to benefit if market trends shift.