Breaking Tradition: Stock Market Thrives in May Amid Election Year Optimism

S&P 500 Posts Strongest May Since 2020, Defying ‘Sell in May’

The S&P 500 index recorded its strongest May performance since 2020, raising hopes for a summer rally and challenging the popular “sell in May and go away” adage.

“Momentum leads price, and a strong May increases the odds of a decent summer rally,” said Ed Clissold, chief strategist at Ned Davis Research, in an interview with MarketWatch. Despite macroeconomic factors like inflation, jobs data, and Federal Reserve remarks influencing market returns, Clissold noted that the current market momentum suggests a bullish trend.

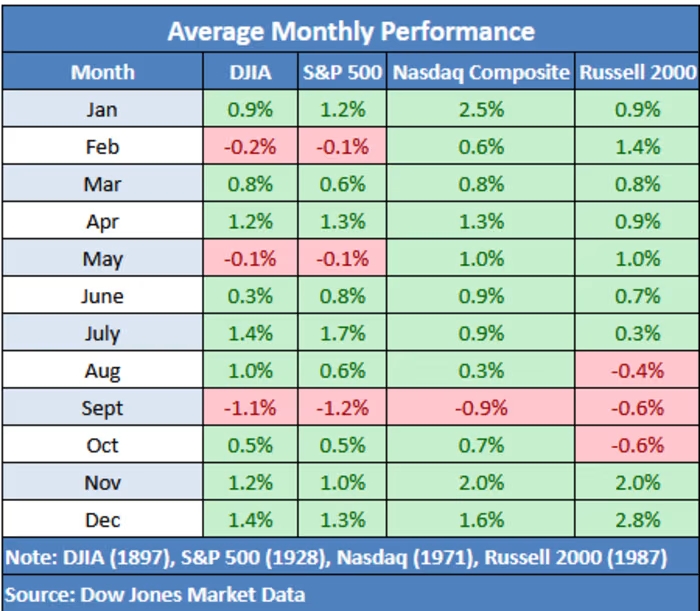

This rally aligns with historical patterns seen in presidential election years. The S&P 500 rose 4.8% in May, its best performance since a 5.3% rise in 2009. Historically, May averages a 0.1% decline, making it the second worst-performing month, according to Dow Jones Market Data.

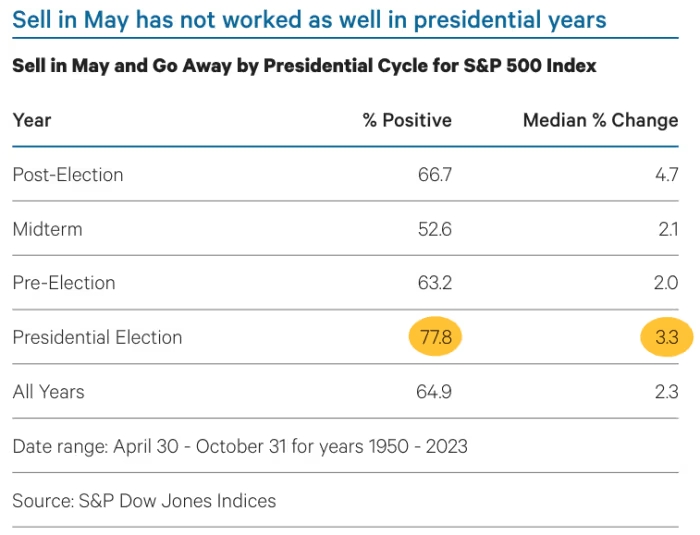

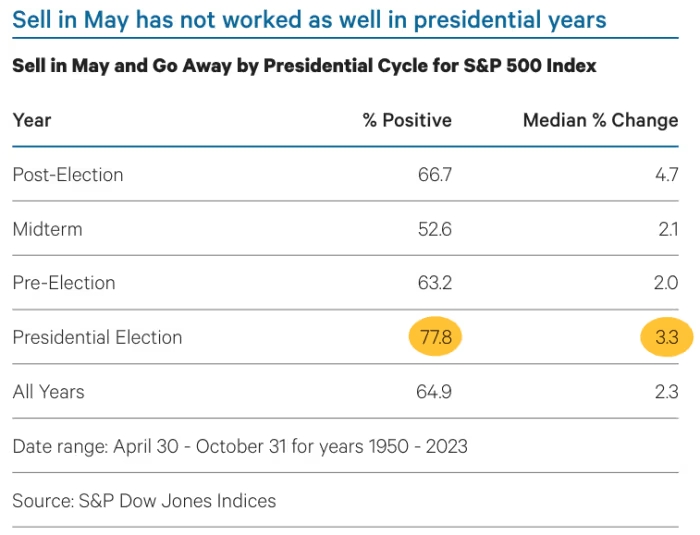

Since 1950, the S&P 500 has risen 77.8% of the time from April 30 to October 31 in election years, with a median gain of 3.3% during this period, the second highest in the election cycle. However, Clissold cautions that a close election could dampen the market, as clear outcomes tend to lead to better performance.

The 2024 election is particularly complex, with Trump being the first former president convicted of a felony and potentially facing a rematch with Biden. The “sell in May” strategy has struggled in recent years, with the S&P 500 rising 10 out of 12 times in May since 2012 by a median of 3%. However, it’s too early to determine if this year’s trend will hold, noted Steve Sosnick, chief strategist at Interactive Brokers.

“We won’t, or can’t, know if ‘Sell in May’ worked until June at the earliest,” Sosnick wrote.