Market Surge Hits Shorts Hard, Warns JPMorgan: Brace for Potential Stock Volatility

On Thursday, Nvidia NVDA saw a roughly 7% peak-to-trough range, ending the day down 3.5%. This volatility has become a hot topic on Wall Street, with Friday’s futures indicating a cautious start.

Is this dip a sign of waning exuberance that recently made Nvidia the world’s most valuable company, lifting many AI stocks along with it? Or is it simply a brief bout of profit-taking for an overbought stock?

Time will tell. However, Nvidia’s downturn on Thursday rattled several major tech stocks, suggesting that the market, after reaching record highs, may now be more sensitive to doubts and unexpected bad news.

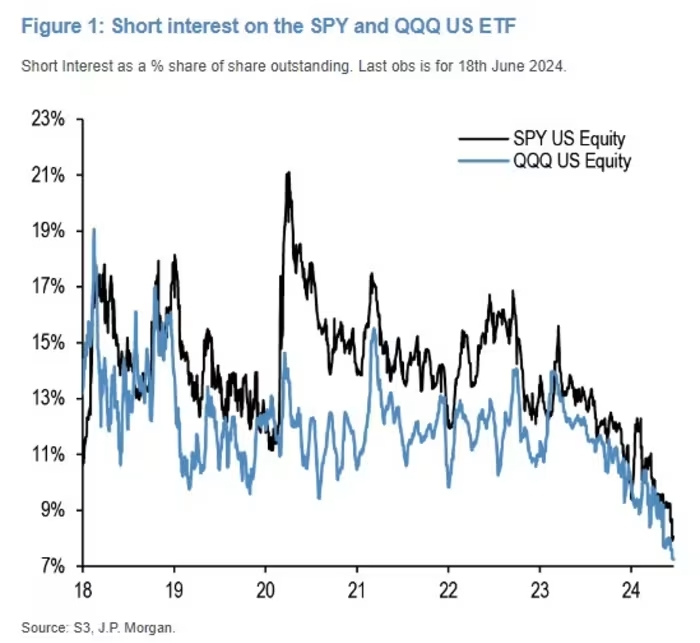

One potential reason for this fragility is record-low bearish positions in key assets, according to JPMorgan analysts led by Nikolaos Panigirtzoglou.

“A key support for the U.S. equity market over the past year was the decline in short interest on the two biggest equity ETFs, SPY (S&P 500) and QQQ (Nasdaq 100),” they noted on Thursday. Short positions benefit from selling an asset and buying it back at a lower price, and they can also hedge long bets.

JPMorgan explains that SPY and QQQ are primary tools for betting on equities at an index level, and the reduction in short interest has supported these indices as short positions were covered.

However, data shows no significant increase in short interest in individual stocks like the Magnificent 7 (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, Tesla) or the S&P 500 over the past year.

Why the decline in short positions? JPMorgan cites three reasons: it’s tough to stay short in a rising market, regulatory demands for transparency squeeze short sellers, and the 2021 meme-stock frenzy deterred some shorts.

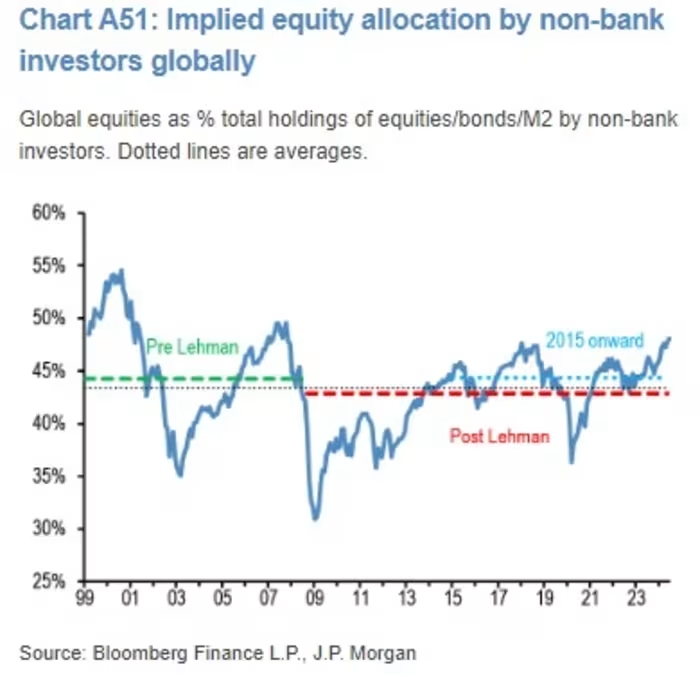

Short-bias equity hedge funds have seen a sharp decline in assets under management in recent years. As short positions fall, non-bank investors globally hold the highest proportion of equities since the financial crisis.

“This steady flow of support from covering short positions has suppressed realized volatility, allowing volatility-targeting investors to take larger equity positions,” says JPMorgan.

Essentially, the decrease in short positions in SPY and QQQ is a bet on low volatility. Given the current low short interest, this implicit short volatility trade is historically extended, posing a risk to U.S. equities if negative news reverses the past year’s decline in short interest, the bank concludes.