Will Earnings Season Stall the S&P 500 Pullback? LPL Insights

On Tuesday, the S&P 500 closed at a record high, boosted by anticipation of a strong upcoming earnings season. LPL Financial expects this season to be “solid,” but increasing growth estimates for the latter half of 2024 might be challenging.

Jeff Buchbinder, chief equity strategist at LPL Financial, remarked that there likely won’t be any setbacks in the AI sector during the second quarter results. He suggested that positive earnings news could delay the long-expected pullback in the S&P 500.

Buchbinder’s research notes that Big Tech will be a significant contributor to the S&P 500’s earnings growth for Q2, with other sectors like healthcare, financials, energy, and utilities also playing important roles.

The earnings season will start with major Wall Street banks, including JPMorgan Chase, Citigroup, and Wells Fargo, reporting their results on July 12. Analysts expect a 9.2% year-over-year increase in S&P 500 earnings per share (EPS) growth for Q2, and Buchbinder forecasts this growth to reach double digits for the first time since Q4 2021.

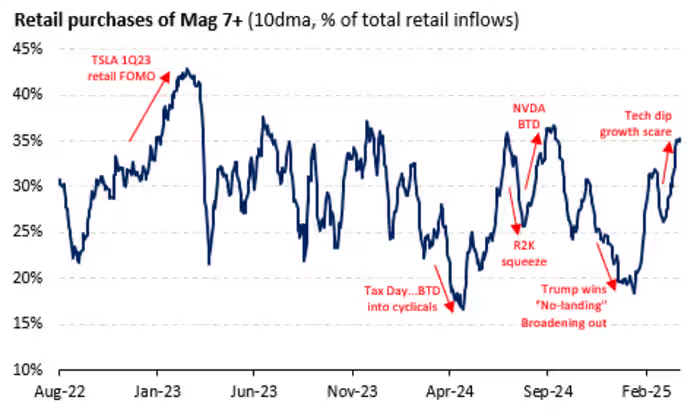

After a 14.5% rally in the first half of 2024, the S&P 500 is continuing its upward trend in July. Buchbinder stressed that earnings growth is key to sustaining or building on these gains. While he believes a pullback is overdue, he advised investors to be patient as the next six weeks of earnings may not present a buying opportunity.

Buchbinder highlighted the “Super Six” — Alphabet, Amazon, Meta, Microsoft, Nvidia, and Apple — as key drivers of the S&P 500’s Q2 earnings growth. He expects the broadening of earnings growth to extend into 2025, with Big Tech remaining influential this year.

He also pointed out the importance of company guidance during earnings season to gauge potential earnings growth for the latter half of 2024. Given the steady economy and continued AI investments, executives are unlikely to significantly lower their outlooks.

On Tuesday, the Dow Jones Industrial Average rose by 0.4%, the S&P 500 by 0.6%, and the Nasdaq Composite by 0.8%. The S&P 500 closed at a record 5,509.01, according to Dow Jones Market Data. Buchbinder anticipates that a market dip might not occur until August, after earnings news has been fully reflected in stock prices.