Reliable Market Signal Says It’s Time to Buy

A closely-watched stock-market indicator is flashing a strong buy signal as more companies’ shares join the rally.

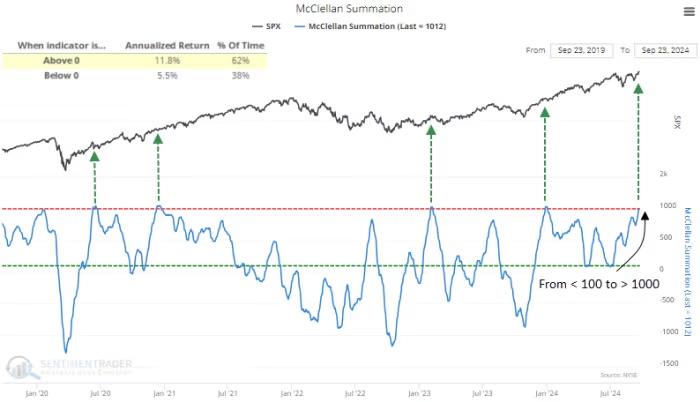

The McClellan Summation Index, which tracks market breadth, has sharply increased, signaling more gains for the S&P 500 with near-perfect accuracy, according to Dean Christians, a senior research analyst at SentimenTrader.

The McClellan Index measures how many stocks are participating in a markets move. When it’s rising, more stocks are rallying, signaling stronger market breadth. When it’s falling, market breadth is weakening, often indicating a broader market sell-off.

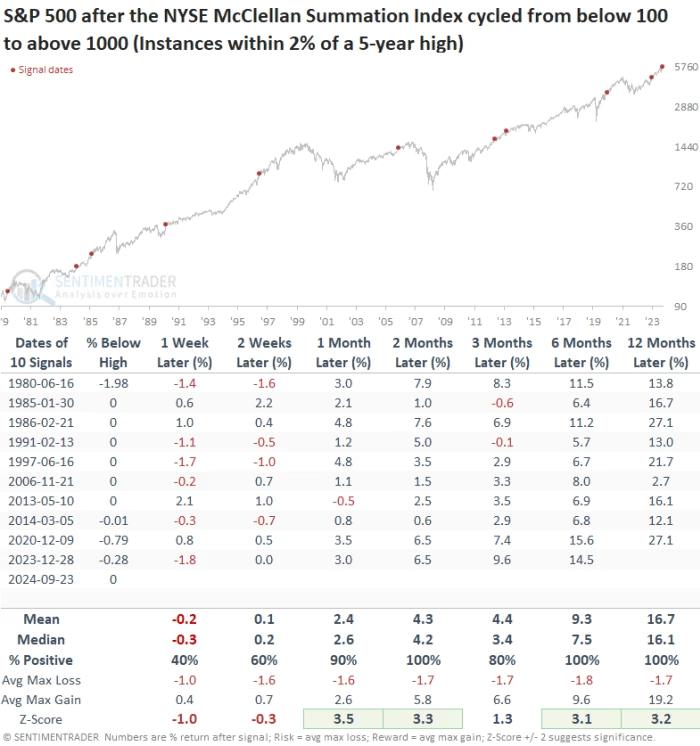

Technical analysts use the index to monitor what’s happening beneath major indexes like the S&P 500. Historically, sharp improvements in the index have accurately predicted further stock market gains. When it surges from below 100 to over 1,000, stocks have gone on to rise over the next year with 96% accuracy.

Even more impressive, that success rate jumps to 100% when the signal occurs while the S&P 500 is within 2% of a significant high. This signal was triggered on Monday.

According to Christians, this means the projected gains are more significant than just the typical upward drift of the stock market over time.

On Tuesday, the S&P 500 rose 14.36 points, or 0.3%, to close at 5,732.93, marking its 41st record close of 2024. The Dow Jones Industrial Average gained 83.57 points, or 0.2%, to 42,208.22, also hitting a record, while the Nasdaq Composite rose 100.25 points, or 0.6%, to 18,074.52, though it remains more than 3% below its July record.