Trader Confidence Back to Pre-Plunge Levels

Citigroup strategists are growing concerned about the current bullish sentiment in the stock market but aren’t advising investors to reduce their positions yet.

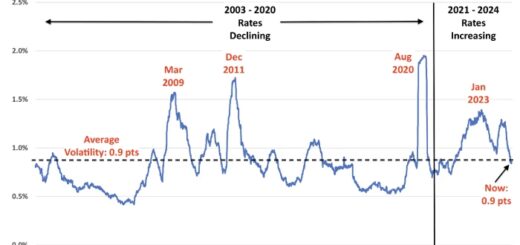

Chris Montagu, Citigroup’s global head of quantitative research, noted that net-long positioning in S&P 500 futures has reached its highest level since July 2023. At that time, such extreme bullish positioning was followed by a sharp three-month decline, with the S&P 500 falling 10%. Montagu warns that a similar pullback could happen if investors aren’t cautious.

“The last time positioning was this stretched, the S&P 500 fell more than 10% over the next 2-3 months. While we aren’t suggesting reducing exposure, positioning risks increase when markets get this extended,” Montagu and his team said in a report shared with MarketWatch.

Nasdaq-100 futures are less overextended than the S&P 500, avoiding the frothy conditions seen in mid-2023 and again in July 2024. The strategists also pointed out that recent short-covering in S&P 500 futures may have driven the market higher.

A key difference from mid-2023 is that investors’ profit-and-loss positions are less stretched now, so they may be less inclined to sell off stocks to protect their gains, Montagu noted.

Additionally, all short positions in both S&P 500 and Nasdaq-100 futures are currently underwater, which could force further buying as trader cover their short positions.

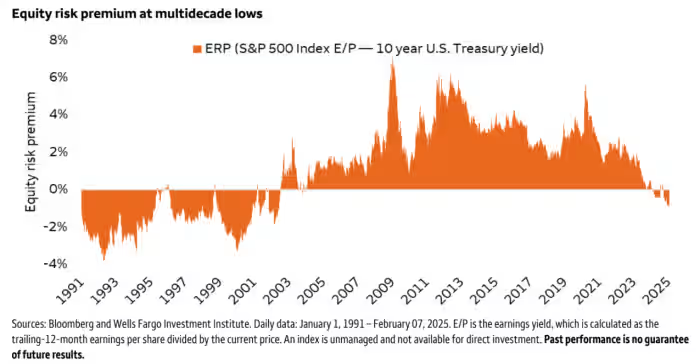

While markets have been climbing in October, Tuesday saw the first consecutive losses for the S&P 500 since early September, as rising Treasury yields reignited concerns of a repeat of the 2023 selloff, when the S&P 500 dropped 10% between August and October.

On Tuesday, the 10-year Treasury yield rose 2.5 basis points to 4.204%, its highest level since July. The S&P 500 fell slightly by 2.78 points (0.1%) to close at 5,851.20. The Dow Jones Industrial Average dropped 6.71 points, and the Nasdaq Composite lost 33.12 points (0.2%).