Boost Your Trading: Live Sonic Webinar

When it comes to achieving consistent success in day trading, understanding the nuances of entry, risk management, and profit-taking is crucial. Here’s a guide based on key insights from a detailed training session on the Sonic trading system.

1. Handling Entries with Precision

With the Sonic system, trades are initiated based on a combination of sound signals and visual indicators. These are represented by “shooting sounds” that signal potential entry points. For each trade setup, it’s essential to assess risk-reward and prioritize trades that offer manageable retracements. Remember: if a trade setup doesn’t feel right, it’s better to skip it and wait for clearer opportunities.

2. Understanding the Software’s Backend Settings

Familiarity with the Sonic software’s settings can enhance your decision-making. The system leverages multiple indicators, including the ATR (Average True Range), to set targets. This setting calculates the average of the previous four candles, helping traders gauge probable market movements and adjust their targets accordingly. In more volatile markets with large candles, targets adjust to capture more substantial profits, while in slower markets, they remain conservative.

3. Adjusting Stop-Loss and Take-Profit Levels

Sonic system users can customize their stop-loss and take-profit parameters. Instead of fixed stop-loss values, the system calculates the stop above a shaded “box” that serves as a buffer for price action. For a balanced approach, many traders prefer a five-tick stop above this box, but the settings allow adjustments down to three ticks.

The ATR-based take-profit can be set at 1, 1.5, or even 2 times the ATR, depending on risk tolerance. For shorter trades, 1x ATR can keep trades concise, while aiming for 2-3x ATR is better suited for longer holds and requires more confidence in market trends.

4. Minimizing Missed Targets with a Front-Run Strategy

For those who prefer a higher hit rate, adjusting profit targets to 75% or 90% of the ATR can help “front-run” the target. This approach means you’re aiming to exit slightly before the target, avoiding the frustration of near misses and securing profits more consistently.

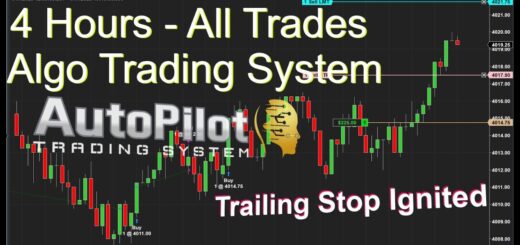

5. System Flexibility Across Markets and Timeframes

The Sonic system’s core advantage lies in its adaptability across various markets, from the E-Mini to currencies and beyond. Although day trading typically uses one-minute charts, the system’s principles also work on larger timeframes for swing trading stocks, currencies, and commodities. A one-minute chart is perfect for active trades, but for swing trades, a daily or hourly chart is more suitable.

6. Balancing Your Day with Realistic Goals

While it’s tempting to trade continuously, setting daily goals and knowing when to stop can lead to better outcomes. If you’re consistently profitable within a few trades, it’s wise to close the day in profit and avoid risking gains in additional trades. Taking breaks and revisiting the market with fresh eyes is crucial for maintaining discipline.

Getting Started with Sonic

Ready to take control of your trading? Visit DayTradeToWin.com to learn more about Sonic and other proprietary strategies. Sign up for a free member account to access trial software, including the ABC method, and start learning price action fundamentals.

Whether you’re interested in Sonic or our comprehensive mentorship programs, you’ll find the tools you need to trade confidently and consistently.