Wall Street’s 2025: U.S. Stocks or Nothing

Not everyone is convinced the bullish outlook will fully materialize. Analysts like Brent Donnelly caution that Wall Street forecasts often extrapolate recent trends, overlooking potential surprises from a new administration likely to implement bold policies.

“TINA” Returns: U.S. Stocks Still Lead the Pack

For over 15 years, large-cap U.S. stocks have outperformed global peers, and top investment banks predict this trend will extend into 2025. With the S&P 500 poised for another year of stellar returns—potentially exceeding 25%—firms like Deutsche Bank, Goldman Sachs, UBS, and JPMorgan Chase are advising investors to stay focused on American equities.

Shifting Leadership in U.S. Markets

While Big Tech has driven market gains in recent years, analysts anticipate a shift in leadership. Sectors like financials and utilities could take the spotlight, according to JPMorgan’s Dubravko Lakos-Bujas. Some strategists also see opportunities in Japanese equities but remain cautious about the eurozone and emerging markets.

U.S. Stocks Face Risks

Despite the optimism, challenges remain. High valuations, rising Treasury yields, and uncertainties tied to policy shifts under the incoming administration could introduce volatility. However, the strong U.S. economy and advancements in artificial intelligence are expected to keep American equities attractive.

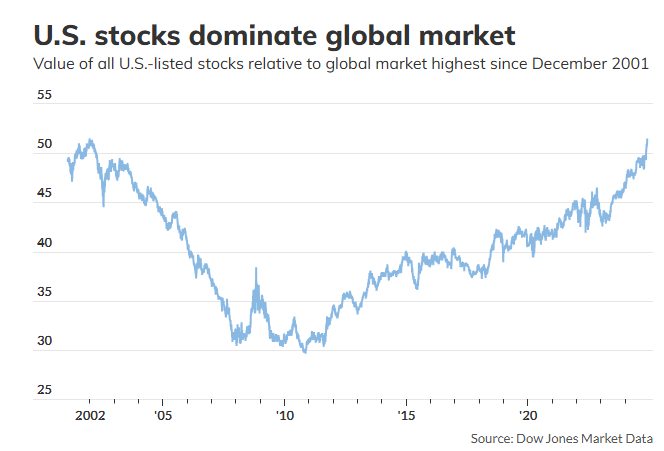

JPMorgan strategists acknowledge potential turbulence but argue that the opportunities outweigh the risks. U.S. stocks now account for over 50% of global market capitalization, a level not seen since 2001, underscoring their dominance.

The “TINA” Argument Makes a Comeback

Société Générale’s Albert Edwards has reignited the “TINA” sentiment—“there is no alternative”—highlighting the continued appeal of U.S. stocks. Superior earnings growth and robust fundamentals are expected to sustain the market’s momentum. While Big Tech remains a key driver, other sectors are gradually catching up.

A Market for Stock Pickers

The evolving market landscape could create a stock picker’s paradise as sector performance diversifies. Wall Street strategists analysts foresee a shift from the familiar leaders of 2023 and 2024, offering fresh opportunities for investors willing to dig deeper.

International markets, while undervalued, lack the appeal of U.S. equities. UBS strategists highlight the unique wealth effect of the U.S. stock market, driven by higher household equity ownership compared to other countries, which amplifies its economic impact.

Contrarian Opportunities in 2025

For now, the combination of U.S. technological leadership, economic resilience, and unmatched market influence reinforces the “TINA” narrative: U.S. equities remain the leading choice for investors seeking stability and growth.