Charting Success: 20 Short Trading Videos to Elevate Your Skills!

Welcome to the dawn of 2024’s first trading day! As traders brace themselves for another year of market fluctuations and possibilities, it’s crucial to set a strong foundation. Today, we delve into the realm of AutoPilot trading systems, exploring their adeptness at maneuvering through the complexities of the market landscape.

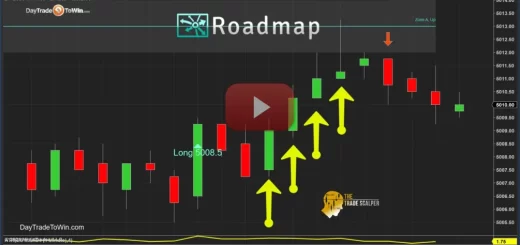

AutoPilot Trading System Overview

AutoPilot trading systems have garnered traction among traders for their capacity to automate trading decisions based on preset criteria. These systems operate sans continual manual intervention, enabling traders to capitalize on market movements while minimizing emotional biases.

Typically, AutoPilot systems scrutinize market data like price action, volume, and technical indicators to pinpoint trading opportunities. Subsequently, they execute trades based on predetermined rules and parameters set by the trader.

Implementing Strategy on the First Trading Day

As the clock strikes midnight on the inaugural trading day of the year, many traders are eager to kickstart their strategies. A common approach is to initiate AutoPilot trading once initial market activity settles, often around 10:00 AM.

On this specific day, we find ourselves ensconced in a long trade, with the market displaying signs of ranging behavior. Traders employing the AutoPilot system might seize this chance to close their positions, securing profits and mitigating risks linked with sideways markets.

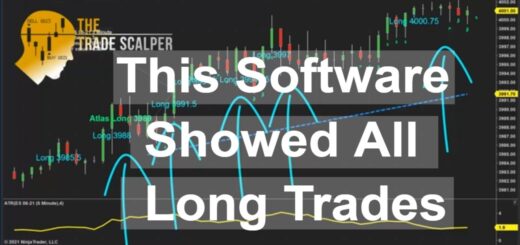

The Trade Scalper Challenge: Day 3

Meanwhile, seasoned traders embark on the third day of the Trade Scalper Challenge, a trial of skill and consistency in executing short-term trades. Leveraging the Trade Scalper program, participants aim to attain profitability over three consecutive trading days, relying on the software’s signals to guide their decisions.

With each signal pointing towards a potential long trade, participants meticulously assess entry points and manage positions based on underlying market conditions. Patience and precision are paramount as they await favorable opportunities to capitalize on intraday price movements.

Key Takeaways for Traders in 2024

As we navigate the intricacies of the trading landscape in 2024, here are some essential tips to consider:

- Price Action Focus: Prioritize price action analysis over traditional indicators for deeper insights into market dynamics.

- Practice and Learn: Utilize practice accounts to refine skills and comprehend chart patterns without risking real capital.

- Start Small: Initiate with micro contracts to minimize risk exposure and focus on gradual learning.

- Understand Market Volatility: Monitor market volatility using tools like the Average True Range (ATR) to gauge potential risks and opportunities.

- Avoid Overtrading: Recognize when to step away to mitigate the risks of overtrading, which can lead to diminished profits and increased losses.

- Time Management: Trade during optimal hours, avoiding periods of low liquidity or heightened volatility.

Incorporating these strategies and insights into your trading approach can empower you to navigate the challenges and seize the opportunities of the market with confidence and precision. Here’s to a prosperous year of trading in 2024!