Election Outcomes That Could Boost Stocks Through January

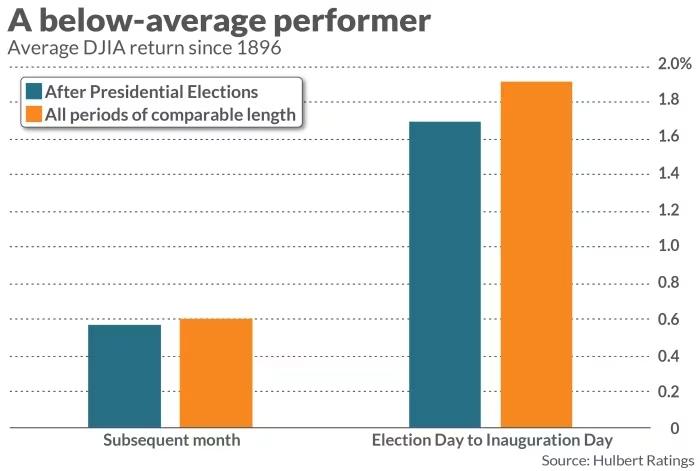

Following Election Day, U.S. stocks often face headwinds—not necessarily because of post-election uncertainty but due to a long-term trend of below-average performance in the immediate weeks afterward.

Historically, stock markets tend to perform better when the incumbent party retains the White House, while declines are more frequent when the opposition takes over.

On average, the Dow Jones Industrial Average has returned 4.4% between Election Day and Inauguration Day if the incumbent party wins, versus a 2.0% drop when it loses.

Since 1900, in 42% of the periods between Elections Day and Inauguration Day, the Dow stocks have ended up lower than it started on Election Day. This serves as a reminder to exercise caution when assuming recent trends will continue uninterrupted.

When the incumbent party loses, any initial rally is usually short-lived. After the campaign ends, the realities of governing set in, and many campaign promises remain unfulfilled, especially for key interest groups.

In elections where the incumbent party lost, the Dow was lower on Inauguration Day 62% of the time, compared to only 28% of the time when the incumbent retained power.

The takeaway? Expect potential volatility after the November 5 election, particularly if the incumbent party loses.