Empire of the Bulls: Understanding Bearish Persistence Amid the U.S. Stock-Market Rally

The robust growth seen in the U.S. stock market during the first half of 2023 continued into the second half, encouraging optimistic investors to remain hopeful. This optimism has pushed the tech-heavy Nasdaq 100 index to increase by 42% for the year to date. On the other hand, conservative investors are trying to foresee when this positive trend will slow down and begin a downward trajectory.

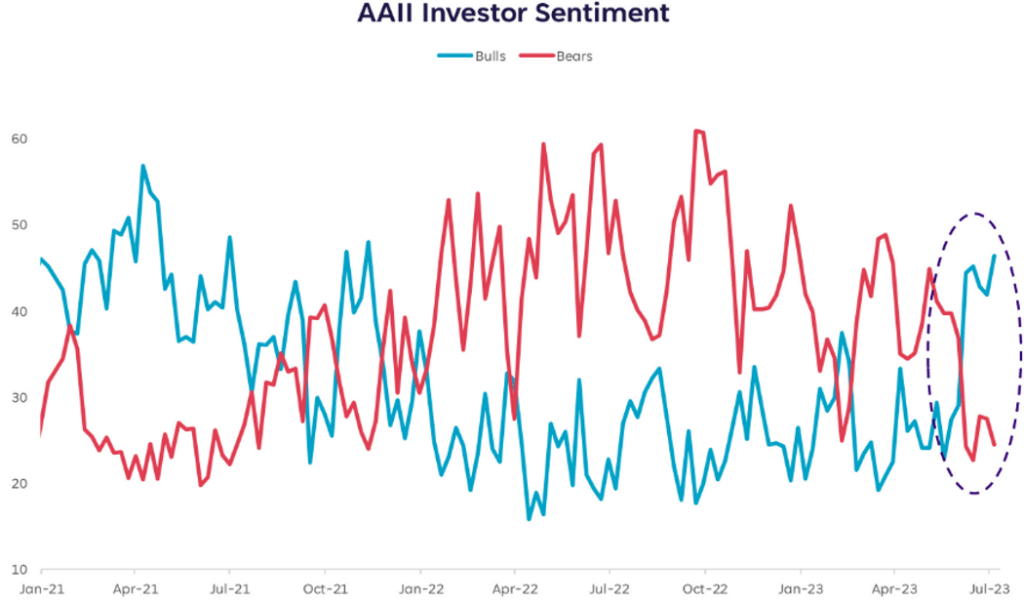

The gap between optimistic stock-market investors, known as bulls, who buy stocks anticipating a rise in value, and pessimists, known as bears, who anticipate a market downturn and attempt to profit from declining stock prices, has notably widened.

Liz Young, SoFi’s chief of investment strategy, compared the current financial conditions to a contentious political environment, with both factions expressing hostility and failing to agree. She stated this was to be expected, given the overwhelming amount of conflicting data, such as the unexpected stock market boom despite negative economic and bond market signs. This week’s encouraging inflation statistics have increased the chances of the Federal Reserve stopping its interest-rate increases. There are growing indications of a soft landing, where inflation returns to approximately 2%, in line with the central bank’s target, without triggering a downturn. On Thursday, for the first time since April 2022, the S&P 500 surpassed 4,500 points, achieving a new peak of 15 months. According to FactSet data, it climbed 2.4% this week, while the Nasdaq Composite increased by 3.2%, and the Dow Jones Industrial Average rose by 2.3%.

MarketWatch obtained insights from market experts who believe that the current disagreement between bullish and pessimistic investors is set to persist. They propose that total optimism will not be realized until there’s clarity over pressing issues related to monetary policy, economic indicators, and the volatility in the Treasury yield curve.

“We persistently face a phase of financial reduction, the conclusion of which is unclear. There’s widespread prediction of a contraction based on multiple economic indicators. There are a variety of signs, such as inverted yield curves, indicating that our financial condition is still unstable,” Young commented in a Friday interview. “Discussions on this subject are continuing, and I am inclined to favor a cautious strategy, particularly in light of the current market assessments.”

The head of applied research at Qontigo, Melissa Brown, indicates that market trends are expected to proceed at a steady yet cautious pace, moving in a two steps forward, one step back manner. However, an event sparking adverse investor emotions could upset this rhythm, much like various incidents that happened in the past year.

A notable rise in the value of prominent technology stocks such as Nvidia Corp., Meta Platforms, and Alphabet Inc. has largely contributed to the S&P 500’s surge over 17% this year. This is majorly due to growing excitement around artificial intelligence (AI). However, Young warns that investors might be overestimating these stocks’ worth due to their infatuation with AI. If these stocks fail to produce the expected results within a year, their current value may not remain attractive.

“When buying shares, your choices are typically grounded on the anticipated profits for the forthcoming year. Although AI could indeed instigate impactful alterations in a variety of sectors, it’s not expected to radically transform the tech ecosystem within this year,” she clarified. The predicted time frame might be the factor that doesn’t go as planned.

Brown from Qontigo pointed out the ongoing volatility in the stock market, which has experienced significant declines since March’s end. This timeframe coincided with decreasing concerns about the banking industry, after the sudden downfall of Silicon Valley Bank. On Friday, The CBOE Volatility Index VIX was noted at 13.31, shortly after hitting the lowest level in more than three years. Typically, a sub-20 VIX value suggests a low-risk environment perception, whereas a value above 20 signifies a period of heightened market volatility.

Brown explained that her models demonstrate an increasing inconsistency between a basic model, which assesses market instability in relation to economic situations, and a statistical model, which establishes volatility grounded on the given data.

The forecasted statistical model exhibits a considerably higher risk than the fundamental model, potentially making it the first occurrence in more than half a decade. This suggests there might be hidden fluctuation indicating that it’s developing under the radar, Brown explained to MarketWatch during a phone call on Friday.

Raheel Siddiqui, Senior Research Analyst of Global Equity Research at Neuberger Berman, has expressed concern over the upcoming liquidity crisis. He notes that investors have significantly more investments compared to their liquid assets, especially with their investments in large capitalization growth stocks.

Siddiqui highlighted in his third-quarter equity market forecast that investor interest is likely to decrease with the reduction of liquidity, something he expects to happen shortly due to potential large-scale withdrawals in the near future. His comments referred to several forthcoming events – the expected scale back by the Federal Reserve of its monthly balance sheet, notably called quantitative tightening, the Treasury’s intention to produce new debt to replenish the Treasury General Account, following Congress’s move to increase the debt-ceiling, and the European Central Bank’s plan to retract €477 billion in TLTRO funding from the banking framework.

Siddiqui’s viewpoint indicates a possible negative effect on shares in the forthcoming time period.

Despite a decrease in optimism, the stock market has remained above average for the sixth consecutive week, as per the latest Sentiment Survey by the American Association of Individual Investors (AAII). There was an increase in both neutral and negative sentiments during the week leading up to Wednesday.

SoFi’s Young observed a significant change in investors’ attitude, moving from consistently pessimistic to optimistic. Even though the graph doesn’t show a stark contrast in the number of optimists versus pessimists, she highlighted that the sudden shift in stance is quite remarkable.

“Young pointed out that swift and notable changes can usually result in a similarly quick and considerable shift as markets and investors attempt to establish equilibrium,”