Treading Carefully: How the Soaring Stock Market Valuation is Making Heads Spin

Zooming in on Valuations: U.S. Stock Market Nears 2022 Bull Market Highs

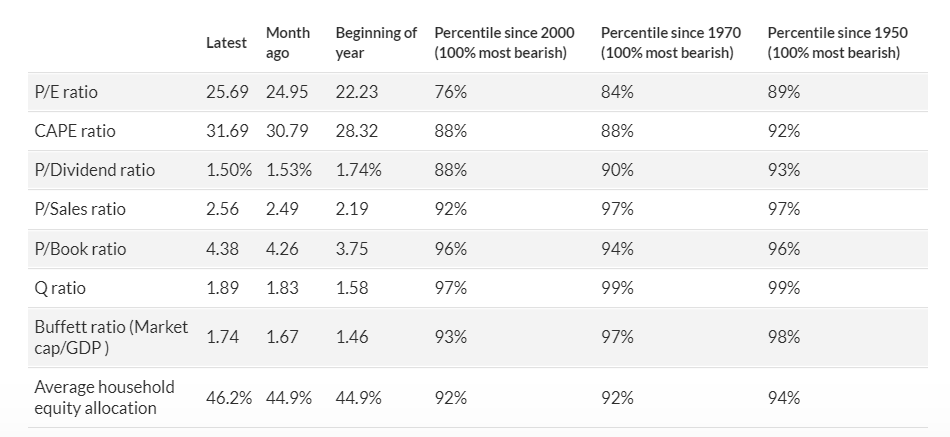

The U.S. stock market’s current valuation is edging ever closer to the lofty levels witnessed during the bull market’s peak in early 2022. This undeniable fact emerges from a comprehensive monthly review of eight valuation models, each with a track record of accurately forecasting subsequent returns in the U.S. market.

While these eight theoretical approaches vary in methodology, their collective message paints a remarkably consistent picture of the U.S. market’s current state. Acknowledging the diversity of these approaches is vital, as individual indicators may be open to criticism due to their inherent limitations. For instance, price/book and q-ratios may be affected by inadequate GAAP accounting for intangible assets, and evaluating the dividend yield may not fully capture the increasing preference of corporations for share repurchases over dividends.

To challenge the bearish signals from all eight indicators, proponents of bullish sentiment would need to demonstrate flaws in each indicator. While theoretically possible, such an argument becomes increasingly difficult and less plausible.

The chart below presents a comparison of the S&P 500’s current valuation with levels observed at the peak of the bull market in early January 2022. Each column represents the percentage of past months in which valuations were lower, with higher columns indicating higher relative valuations.

Across different comparison periods, whether reaching back to 2000, 1970, or 1950, the consistent message prevails: U.S. stocks are presently nearly as overvalued as they were during the previous bull market peak.

This development raises concerns, as bear markets are expected to significantly reduce valuations, providing a sturdier foundation for the subsequent bull market to reach even greater heights. However, the most recent bear market defied expectations, leaving us short of a return to early-2022 peak valuations, yet today’s S&P 500 valuation remains highly stretched.

Predictive Power of Valuation Models

For bullish investors, some consolation can be found in the realization that these valuation indicators offer limited insight into the market’s short-term direction. Instead, their predictive abilities shine on a longer horizon, typically spanning five to ten years. Consequently, despite the current market overvaluation, it is plausible for stocks to continue their ascent in the coming months. However, this scenario would entail the S&P 500 resting on an even more precarious foundation than it currently does.