Timing Your Exit: Should You Pull Money Out of the Stock Market?

Investing can cause stress as we aim to make the best decisions for our future financial situation. However, it can be challenging to navigate through unpredictable market conditions. More specifically, individual investors frequently contemplate how they should respond during a market decline or when experts predict an approaching economic downturn.

In times of uncertainty, you might consider transferring your investments from stocks and stock funds to cash. Nevertheless, whether or not you should make this decision depends on which part of your investment portfolio you are specifically referring to.

When it comes to the portion of your investment portfolio that you utilize to pay for expenses, such as your child’s upcoming tuition bill, it might be prudent to convert those assets into cash. This is because if you are required to make a payment of $25,000 at the start of the following month, it would not be practical to have a balance of only $20,000.

The word “cash” can encompass tangible money, such as funds in a bank account or a money market fund, as well as short-term bonds or bond funds that have stable values resembling cash.

On the other hand, what about the money you have set aside for your future? What about the bank accounts you are utilizing to save for your retirement, which could still be many years or even decades in the future? Completely committing to holding cash is not a suitable strategy for this long-term portion of your investment portfolio.

Should you consider selling your stocks when prices are decreasing?

Why is it not advisable to withdraw money from the long-term portion of your investment portfolio? Instead, why not consider selling stocks and stock funds as a way to mitigate or avoid additional financial losses?

Experienced investors, who may have grown used to changes in the market, still feel upset when the value of their investment portfolios goes down. However, it is crucial to distinguish between a decrease in value and actually losing money. The losses are only considered genuine and concrete when the investments are sold.

Some investors think they can handle difficult market situations by selling their investments when prices are low and buying back when the market improves. However, accurately predicting the best time to enter or leave the market is very difficult, and even experienced experts often fail. This is especially true for investment funds.

Sell High, Buy Low?

Investors, especially those relying on funds like regular savers with retirement accounts, often make the error of selling their assets at low prices when trying to determine the optimal time to invest in the stock market. This not only results in incurring losses but also causes them to miss out on potential profits by not actively participating in the market during a rally.

This is due to the fact that rallies typically commence without warning, causing individual investors to hesitate in getting back into the market. They worry that these fresh rallies are merely short-lived and have long been ridiculed as “dead-cat bounces” by investors.

According to the Dalbar Quantitative Analysis of Investor Behavior report, the average stock investor had a 17.29% growth in 2020, indicating the reliability of the data. While this increase is not considered bad, it is slightly lower than the overall market growth of 18.40%.

In 2021, the gap became wider as the average worth of stock investments among individual investors went up by 15.25% in the first six months. Nonetheless, this increase was lower than the overall market’s progress of 17.36%.

Why the gap?

According to Corey Clark, the Chief Marketing Officer at Dalbar, individual investors commonly make unwise choices when attempting to predict the market. They frequently sell stocks when their prices are at a low point and purchase them when prices are high. Furthermore, their decision-making is typically flawed, resulting in significantly greater losses compared to their gains. This implies that their main problem stems from making more incorrect predictions than accurate ones.

Learning to Live With Volatility

After any market decline, no matter how severe, the market always recovers its value. The same goes for properly diversified investment portfolios, as they also bounce back. Therefore, it is not beneficial to repeatedly enter and exit the market as it has a negative impact on your portfolio’s performance.

Experts advise that individuals must acknowledge and embrace the fact that market volatility is a regular event in the stock market. They emphasize the importance of either enduring or reducing its impact to a manageable level.

In the beginning of the 21st century, the S&P 500 Index experienced a substantial decrease in value of nearly 50% due to the bursting of the dot.com bubble. This was followed by the Great Recession, which occurred from 2007 to 2009 and led to an even larger drop of approximately 60% in the index’s value. In more recent times, the outbreak of the Covid-19 pandemic resulted in a swift decline of the S&P 500, with a decrease of 34% occurring within a single month in March 2020.

Nevertheless, following each of those decreases and subsequent periods of declining stock prices, there was a subsequent rise. The S&P 500 not only rebounded but also surpassed previous high points. On average, since 1929, periods of declining markets have experienced decreases of 37.3%. Conversely, the subsequent periods of rising markets since 1921 have experienced average gains of 164%, as stated by Sam Stovall, the chief investment strategist at CRFA Research.

The obvious conclusion is that individuals who maintain their investments for an extended period of time are given benefits by the market.

Remain focused and maintain self-control, even in situations that are not easily foreseeable.

It is clear that there are benefits to maintaining self-control and sticking to your plan when the market is unpredictable. However, many people struggle to bridge the gap between understanding what is correct and actually implementing the necessary steps.

Research suggests that the pain resulting from monetary loss outweighs the pleasure derived from financial gains. Both emotions and cognitive biases contribute significantly to this occurrence, posing a challenge to overcome. Nonetheless, there are steps one can take to strengthen their resolve in the face of unpredictable market circumstances.

Create goals for yourself and formulate a plan for effectively controlling your financial situation.

The majority of investors prioritize saving for retirement as their main financial objective. However, there are also other long-term goals to consider, such as saving for education or buying a home. Additionally, there are shorter-term goals like starting a business.

Every individual has unique financial goals, and these goals may shift based on various life experiences. Nonetheless, stocks have a significant impact on achieving lasting growth in your investment portfolio, making it essential to maintain dedication and concentration in order to attain the outcomes you desire.

Developing and sticking to a financial plan is the most successful method to achieve your objectives. Many investors struggle to resist the urge to sell when faced with economic difficulties and market instability. Nevertheless, it is essential to stay committed to your long-term strategy.

Working with a skilled financial advisor is a highly successful approach to maintain concentration. They can help in developing a plan and ensuring your dedication remains unwavering, even when faced with obstacles.

Understand Your Risk Tolerance

Developing an investment strategy includes taking into account essential aspects such as your economic objectives, the duration of your investment commitment, and your readiness to embrace uncertainties.

Determining risk tolerance can be quite difficult compared to the other two factors. Risk tolerance specifically pertains to how much risk you are comfortable taking in pursuit of a specific level of profit. Nonetheless, it is essential to determine your risk tolerance as it directly affects the potential return on your investments. If you are willing to take on higher levels of risk, you have the potential to earn greater profits.

Moreover, having knowledge of your risk tolerance level helps in creating an investment portfolio that grows steadily in worth while avoiding excessive market volatility that could cause unease. The advancement of your portfolio is essential as it allows you to accomplish your desired goals, be it retirement, education, travel, housing, or any other ambitions.

What steps should be taken when you need help with your investment?

If you are not confident about grasping your readiness to take chances or how it matches your goals and timeline, it can be advantageous to seek help from a financial advisor. They have the knowledge to ask about certain aspects and help you question your own beliefs, enabling you to assess and adjust them as necessary.

If you experience worry when it comes to making financial choices, anFd the thought of your investments declining during market slumps causes you stress, it is important to recognize these feelings and employ tactics to manage your responses and remain dedicated to your financial goals.

Having a skilled financial advisor and a diverse investment portfolio can be advantageous when dealing with varying market situations. Engaging in conversation prior to any potential market decline can aid in creating suitable approaches to adopt during times of market volatility.

Focus on Asset Allocation

Looking at how the S&P 500 has performed in the past shows us the importance of stocks in achieving financial goals over a long period.

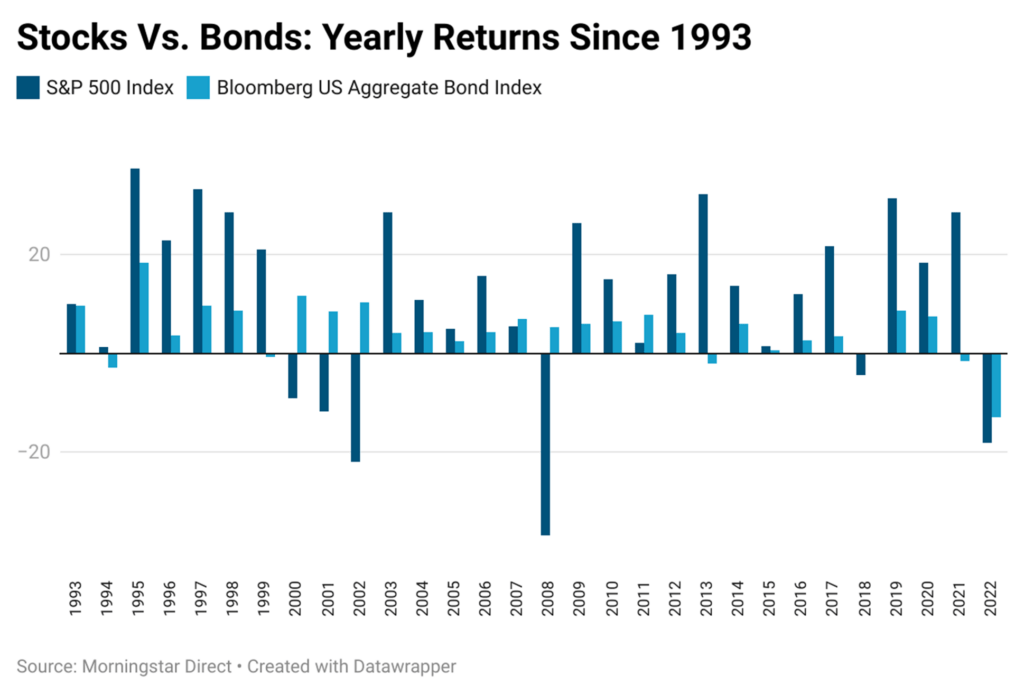

From 1992 to 2022, stocks, as represented by the S&P 500, consistently performed better than bonds as shown by the graph. The average yearly growth rate of stocks was 11.25%, which is nearly two and a half times higher than the more modest average annual growth rate of bonds, represented by the Bloomberg US Aggregate Bond Index, which was 4.7%.

Over a span of 30 years, stocks outperformed bonds in 22 of those years. If you had initially invested $10,000, your investment would have grown to more than $158,000 by the end of last December. This calculation is based on an imaginary S&P 500 Index fund that does not have any fees and is kept within a retirement account that defers taxes.

In case you had invested your money in a comparable fictitious bond fund on Bloomberg Agg without any charges or taxes, your ultimate amount of money would have risen to about $38,000. This is a reminder that stocks have significantly greater potential for growth in the long term when compared to bonds.

Using Bond Funds as Shock-Absorbers

Nevertheless, it is advantageous to include bonds in your investment strategy, and utilizing bond funds can simplify this process. What is the reasoning behind this recommendation? The act of diversifying your portfolio is essential for successfully achieving your objectives and protecting against potential risks and market fluctuations. Through diversification, you can safeguard yourself from the adverse consequences of a decreasing stock market.

It is typical to include fixed income investments in a diversified approach, although bonds typically yield lower profits compared to stocks. In addition, bolstering your investment portfolio with alternative investments like real estate, which perform well when the stock market is weak, can further improve the overall stability of your investments.

Gaze once more at the image provided. It demonstrates that stocks, as shown by the S&P 500 Index, generally have a faster pace of growth than bonds. Nevertheless, bonds can be employed as a safety net to reduce the overall instability of a portfolio. This is especially beneficial if your goal is to minimize the drastic fluctuations that stocks frequently go through in different years.

Benefits of Diversification

One widely employed approach to take advantage of the upward potential of stocks while also ensuring the stability provided by bonds is to maintain a mixture of 60% stocks and stock funds, along with 40% bonds and bond funds. This distribution may be adjusted according to your personal comfort level with risk.

In order to craft a successful portfolio, it is crucial to incorporate various assets that are not closely connected in terms of performance. For instance, when investing in stocks, one can boost diversification by allocating more towards defensive stocks. These types of stocks may have slower growth rates compared to technology stocks with high growth potential. Nevertheless, they offer a more steady investment experience as they are less influenced by market fluctuations.

Best Way to Build Long-Term Wealth

Although investing in the stock market can cause anxiety, it is without a doubt the most successful way to amass wealth over time.

Between 1926 and July 31st, the large-cap stocks in the S&P 500 Index have recorded an average yearly gain of more than 10%. In a similar vein, small-cap stocks have displayed an average return of nearly 12%. These consistent gains have endured through challenging times of market instability and economic decline, such as the Great Depression, World War II, the dot-com bubble bursting, and the Great Recession.

Experiencing a drop in the value of your portfolio can be distressing in the short term. Nevertheless, it’s crucial to avoid the harmful urge to sell during tough periods. Historical events have shown that investors who maintain discipline are ultimately rewarded by the market.