Federal Reserve Talks and GDP Numbers Stall Stocks in Today’s Market

On Wednesday, the US stock market displayed a mixed performance as investors grappled with the prospect of the Federal Reserve implementing an earlier-than-expected interest rate cut. Additionally, updated data revealed a faster growth rate in the US economy for the third quarter than previously reported.

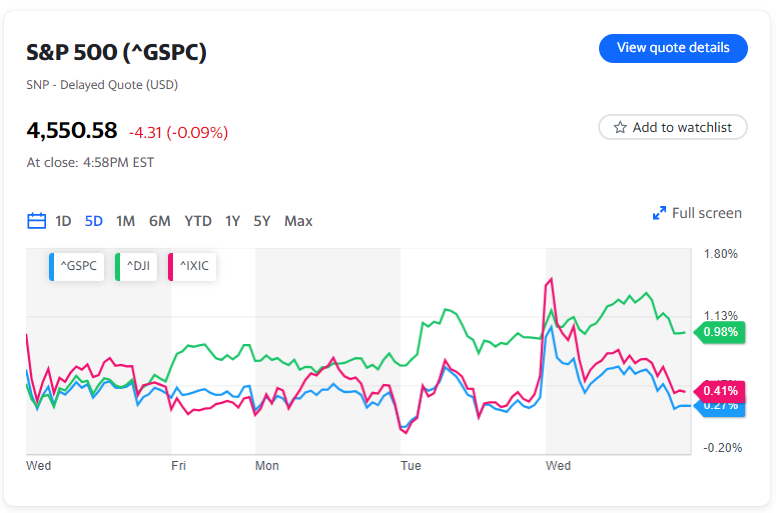

The Dow Jones Industrial Average (^DJI) emerged as the primary gainer, barely crossing the neutral line. In contrast, both the benchmark S&P 500 (^GSPC) and the tech-heavy Nasdaq Composite (^IXIC) saw a marginal decline of around 0.1%.

The possibility of a policy shift gained momentum after statements from Fed Governor Christopher Waller, who indicated that there was “no reason” to insist on maintaining “really high” rates if inflation consistently eases. While Fed Governor Michelle Bowman held a different view, echoing Waller’s dovish sentiments were other officials, including Chicago Fed President Austan Goolsbee, expressing concerns about keeping rates “too high for too long.”

Further insights: Navigating the Implications of the Fed’s Pause in Rate Hikes on Bank Accounts, CDs, Loans, and Credit Cards

Noteworthy investor Bill Ackman is now among those speculating that the Fed might initiate rate cuts sooner than initially expected, suggesting this move could occur as early as the first quarter.

Bonds experienced increased gains fueled by these dovish remarks, leading to a 6-basis-point drop in the 10-year Treasury yield (^TNX), reaching around 4.27%—its lowest level since September.

The latest report on US third-quarter GDP revealed a robust growth rate of 5.2% on an annualized basis, representing an upward revision from the previously reported 4.9% pace.