Tom Lee’s Take: Will the Stock Market Reach New Heights or Face February Freeze?

Key Insights for the U.S. Trading Day

As we approach the final trading day of 2023 on Wall Street, all eyes are on the S&P 500 index bulls, who seem poised for a potential record high. Drawing a parallel to a football team needing that crucial push, Tom Lee, Head of Research at Fundstrat, offers a reassuring perspective, suggesting that even if the new high doesn’t materialize today, it’s likely to unfold in January.

Highlighting the infrequency of a market sharply declining, rebounding to its previous peak, and then experiencing a significant retreat, Lee points to historical data since 1950. He emphasizes that in the 11 instances where the S&P 500 fell 20% and nearly reached its prior all-time high, the index promptly made an all-time high in each case. The median time for achieving this record was seven days, potentially extending to 20 days, hinting at new highs in January 2024.

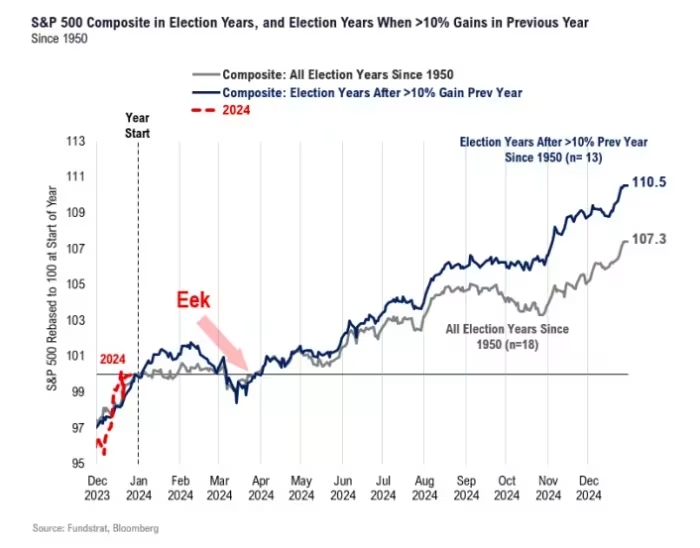

While projecting further market gains and a median max gain of +22% over the next 18 months, Lee injects a note of caution. Citing historical patterns, he notes that seven out of the 11 instances involved market consolidation with modest pullbacks, typically ranging from 2% to 5%, potentially bringing the S&P 500 down to the 4,400-4,500 range.

Lee outlines four potential reasons for a pullback this time. First, market impatience could arise while awaiting the Federal Reserve to initiate interest rate cuts, intensifying if there are signs of central bank officials expressing uncertainty about easing policy, expected in March.

Second, a potential delay in big technology companies benefiting from AI revenues due to what Lee terms a “systemic hack by malevolent AI” could impact the timeline.

Third, Lee attributes the need for market consolidation to the “parabolic gains” witnessed in late 2023, with the S&P 500’s relative strength index staying above the overbought threshold of 70.

Finally, Lee suggests that a market pullback in February to March aligns with historical patterns seen in election years.

Despite these considerations, Lee remains optimistic about the prospective drawdown, aligning with his forecast that the majority of the market’s gains will manifest in the second half of 2024, ultimately propelling the S&P 500 to 5,200. Additionally, he anticipates small-caps to rally through the broader market downturn, projecting a 50% jump in the iShares Russell 2000 ETF next year, citing falling interest rates, a dovish Fed, improving economic momentum, and an upturn in housing as contributing factors.