2024 Market Uncertainty: The Ongoing Battle Between Investors and Rate-Cut Speculations

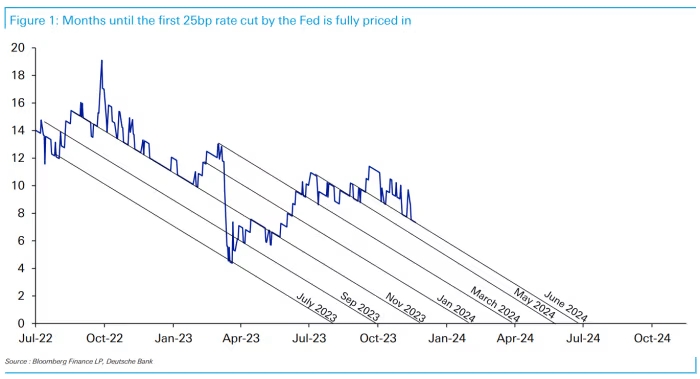

Stock investors have had a tumultuous beginning to the new year, grappling with uncertainties surrounding the Federal Reserve’s 2024 interest-rate cuts in terms of timing and magnitude.

The impressive nine-week winning streak across all major U.S. stock indexes abruptly ended on Friday. This shift was prompted by unexpectedly strong job gains in December, causing traders to briefly reconsider the likelihood of a Federal Reserve rate cut in March.

The S&P 500 (SPX) and Nasdaq Composite (COMP) also failed to initiate a Santa Claus Rally in the final five trading days of 2023 and the first two sessions of 2024, as doubts arose about the market’s anticipation of multiple rate cuts.

This situation offers a glimpse into potential challenges for investors in the coming year. The “January effect,” a theory suggesting higher stock gains this month, may face obstacles, including stagnating progress on inflation. Despite recent hopes for six or seven quarter-percentage-point rate cuts by the Federal Reserve in 2024, starting in March, the reality is setting in during the early days of the new year.

Concerns have emerged about the feasibility of multiple rate cuts, as such a move is often associated with recessions rather than a gentle economic landing. Mike Sanders, head of fixed income at Madison Investments, cautions that excessive rate cuts could undermine the fight against inflation, potentially leading to a cycle of rate hikes.

Uncertainty persists regarding the trajectory of U.S. interest rates, presenting a challenge for investors and potentially tempering the optimism that fueled the remarkable performance of major stock indexes in 2023. Financial markets, operating with high expectations for 2024 rate cuts, may need to reconcile these expectations with the possibility of a less aggressive approach by the Federal Reserve.

The upcoming week includes crucial economic updates, with the release of December’s consumer price index report on Thursday. The market is closely monitoring inflation trends, as the Federal Reserve navigates uncertainties surrounding the most likely path of inflation and the labor market.

Rate-cut expectations are anticipated to be a central theme in 2024, with a cautious approach recommended to avoid premature actions unless there is a significant deterioration in the economic landscape.