The S&P 500 Pathway: Anticipating Market Rally Pre-Fed Rate Cut

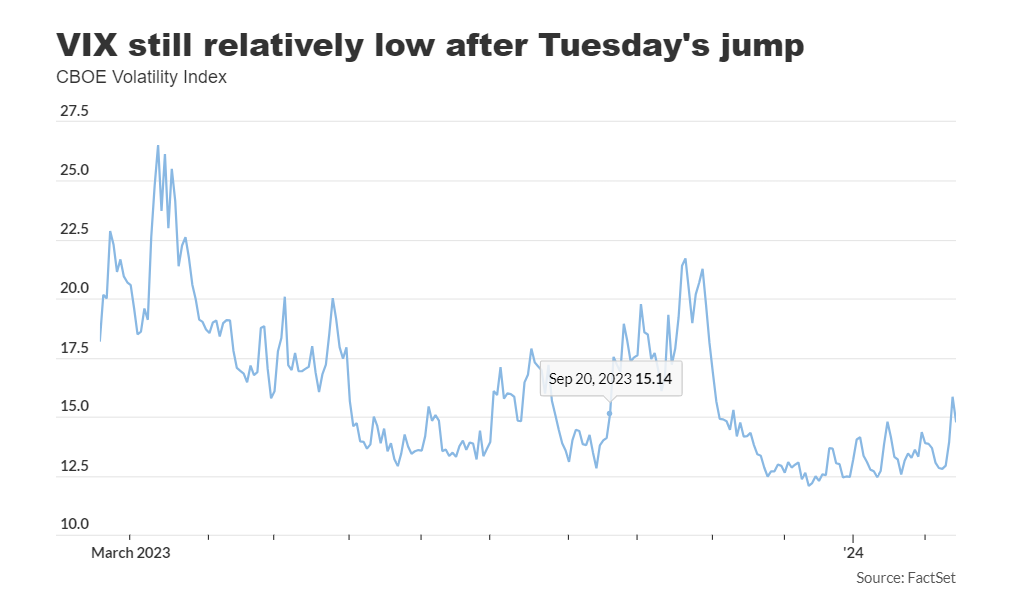

Wednesday witnessed a relaxation in the VIX, commonly referred to as the stock market’s ‘fear gauge,’ following its surge on Tuesday in response to higher-than-expected inflation figures. Despite this spike in volatility, U.S. stocks might maintain their upward momentum before the Federal Reserve’s anticipated initial interest rate cut, according to research from DataTrek.

Although the S&P 500 experienced a significant 1.4% decline on Tuesday, marking its most substantial drop since January 31, it remains in positive territory for the year and since the Fed’s last rate hike in July, as per FactSet. The index, which tracks the performance of large-cap U.S. stocks, showed signs of recovery on Wednesday afternoon with around a 0.6% increase.

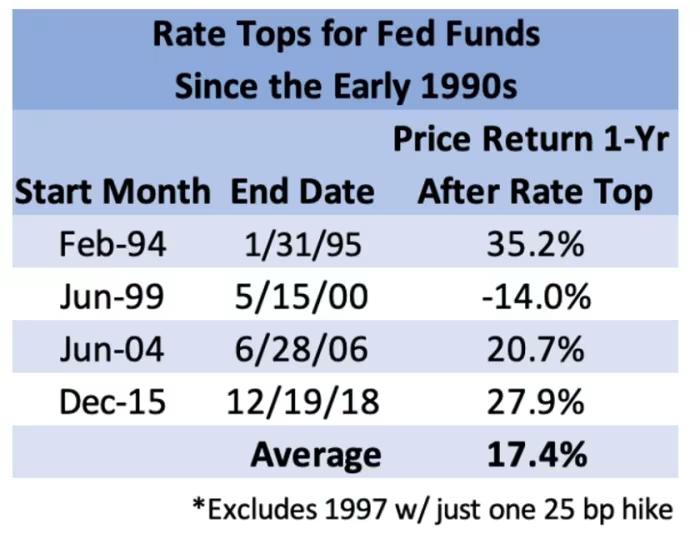

Since the Fed’s July rate hike, the S&P 500 has surged by 8.5%, aligning with historical patterns of post-rate-hike rallies, as noted by Jessica Rabe, co-founder of DataTrek. Rabe’s analysis suggests further potential gains for the S&P 500, citing historical data that indicates an average increase of 28% in the year following a rate-hike cycle cessation, except for the period after the dot-com bubble burst in 2000.

Despite these positive indicators, Rabe cautions that the Fed has not yet initiated a rate-cut cycle, primarily due to a robust U.S. labor market and persistent inflationary pressures, as highlighted in Tuesday’s consumer-price index report.

The surge in U.S. stock market volatility on Tuesday, prompted by the CPI inflation report, saw the CBOE Volatility Index (VIX) spiking to nearly 18 during intraday trading, although remaining below its long-term average of 20, according to Nicholas Colas, co-founder of DataTrek. Colas emphasizes that even with the VIX hovering around 17, the market still reflects a bullish sentiment rather than a bearish one.

Following Tuesday’s inflation report, Treasury yields surged, leading to a sell-off in stocks. The 10-year Treasury note yield rose to 4.315%, its highest level since late November, while the 2-year Treasury yield reached 4.654%, the highest since mid-December.

Investor expectations for Fed rate cuts this year have moderated, with Fed-funds futures now suggesting approximately four rate reductions based on 25-basis-point cuts, and potential rate decreases starting as early as June.

Despite the optimism, historical trends suggest that while U.S. equities may receive an initial boost from the Fed’s first rate cut, sustained gains are not guaranteed, especially given the prevailing macroeconomic and geopolitical landscape. Nonetheless, the S&P 500 has shown resilience, posting gains both this year and in the previous year, underscoring a continued bullish outlook for U.S. large-cap stocks.