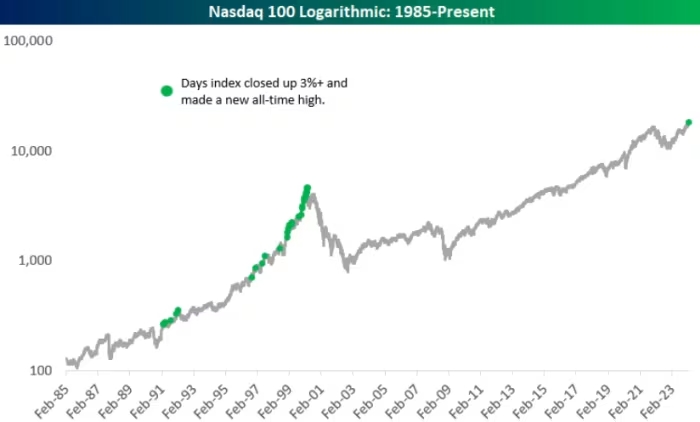

Nasdaq 100’s Historic 3% Surge: Drawing Parallels to the Dot-Com Bubble

Bespoke analysts anticipate a potential downturn in U.S. stocks in the weeks ahead, citing historical trends and seasonal vulnerabilities. The recent surge in the Nasdaq 100 index, reminiscent of the dot-com era’s exuberance, has raised concerns. While such significant gains haven’t been observed since March 2000, similar occurrences were common during the lead-up to the dot-com bubble’s peak.

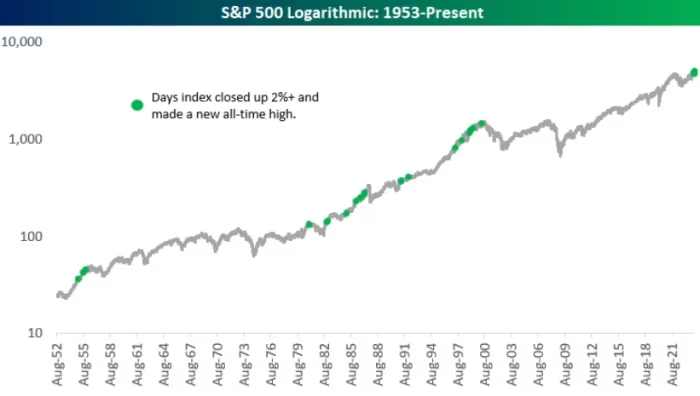

Similarly, the S&P 500’s recent climb to a new all-time high, not seen since March 2000, is cause for caution. Previous instances of such rapid gains in the index have resulted in mixed performance in the subsequent days and weeks.

Despite positive economic indicators and strong quarterly results driving market optimism, questions persist about the rally’s sustainability, especially regarding potential interest rate adjustments by the Federal Reserve.

The recent market surge followed Nvidia Corp.’s impressive revenue forecast, pushing major indexes to new record highs. However, parallels drawn between current market trends and the dot-com bubble raise concerns among market participants.

While Bespoke analysts refrain from directly equating the current rally to the dot-com bubble, they point to historical patterns and the traditionally weak performance of stocks in the upcoming month as potential signs of an impending pullback.

On Friday, U.S. stocks mostly closed higher, with the Nasdaq Composite fluctuating and the S&P 500 and Dow industrials poised for further record highs and their most significant weekly gains of the year.