Nasdaq’s Pullback-Free Run: Time to Brace for a Shakeout?

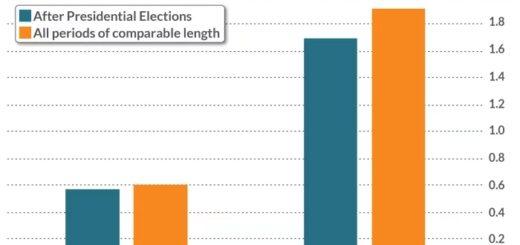

Jonathan Krinsky, the chief market technician at BTIG, highlights that the Nasdaq-100, heavily weighted towards tech, has not seen a pullback of 2.5% or more in 303 trading sessions, marking it as the third-longest streak since 1990. While this streak does not necessarily indicate an immediate downturn in the AI-driven surge in U.S. stocks, Krinsky suggests that the market is overdue for some volatility.

Krinsky notes that the Invesco QQQ Trust Series ETF (QQQ), which mirrors the Nasdaq-100, has reached 14 consecutive record highs in 2024, with the latest on Friday, closing at $445.61 with a 1.5% increase. However, according to FactSet data, the last significant pullback of 2.5% or more occurred on Dec. 15, 2022, when QQQ dropped 3.4%.

Interestingly, despite Apple Inc.’s historical significance in the index, its current performance tells a different story. While Apple’s shares fell 9.1% year-to-date, the Nasdaq-100 climbed 8.3%, according to FactSet.

This divergence among megacap tech stocks, dubbed the Magnificent Seven, has been evident since the beginning of 2024, as seen in Monday’s trading session: Nvidia Corp. surged 3.6%, Tesla Inc. declined 7.2%, Alphabet Inc. dipped 2.8%, and Apple slipped 2.5%.

Krinsky emphasizes the importance of recognizing the disparity beneath the surface, suggesting that while it’s positive to observe a broadening beyond the ‘AI’ trade, the continued momentum in certain names may lead to consequences, even if only in the short term.

On Monday, weakness in several megacap names affected the Nasdaq, leading both the Nasdaq-100 (NDX) and the Nasdaq Composite (COMP) to finish 0.4% lower. The S&P 500 also experienced a slight decline after briefly turning positive, while the Dow Jones Industrial Average ended the day in negative territory as well.