S&P 500 Futures Hold Steady Following 17th Record High

Wednesday’s early trading saw U.S. stock futures hinting at another potential record high for the S&P 500, despite investors brushing off a slightly higher-than-anticipated inflation report. Here’s the latest on how stock-index futures are performing:

- S&P 500 futures slipped 2 points to 5,239.

- Dow Jones Industrial Average futures fell 5 points to 39,475.

- Nasdaq 100 futures eased 25 points, or 0.1%, to 18,452.

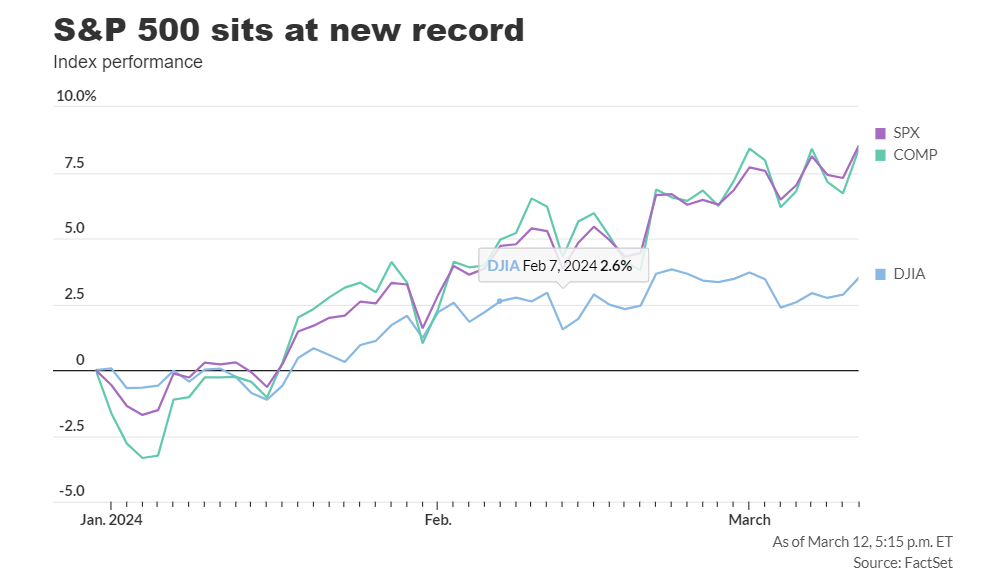

On Tuesday, the Dow Jones Industrial Average climbed 235.83 points, or 0.61%, closing at 39,005.49. The S&P 500 added 57.33 points, or 1.12%, ending at 5,175.27, while the Nasdaq Composite rose 246.36 points, or 1.54%, to 16,265.64.

The S&P 500 is now eyeing its 18th potential record close of the year, with investors seemingly unfazed by the slightly stickier consumer price index report, maintaining optimism for at least a 25 basis point interest rate cut in June.

Despite February’s U.S. core CPI figures suggesting caution for the Federal Reserve, Stephen Innes, managing partner at SPI Asset Management, believes there’s still time for data to sway the central bank’s decision before its June meeting. Market expectations for rate cuts remain stable, with only a slight uptick in 10-year yields.

Analysts note a shift in focus away from inflation data’s impact on stock markets, as growth in the tech sector and confidence in economic stability continue to drive sentiment. Susannah Streeter, head of money and markets at Hargreaves Lansdown, highlights the prevailing positive outlook driven by the resilience of the U.S. economy.

Tuesday’s market gains, including a notable surge in Nvidia shares, are attributed in part to the fear of missing out (FOMO) on AI-related stocks, according to Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

Corporate updates for Wednesday include earnings reports from Dollar Tree, Petco Health & Wellness, and Williams-Sonoma before the opening bell, followed by UiPath, SentinelOne, and Lennar after the market close. No major U.S. economic reports are scheduled for release on Wednesday, and with the Federal Reserve observing a quiet period ahead of its policy decision next week, no Fed speakers are expected.