The Bitcoin Factor: Citi’s Guidelines for a Balanced 60/40 Portfolio

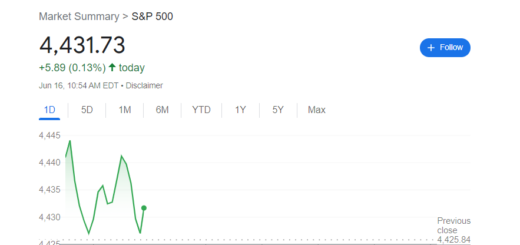

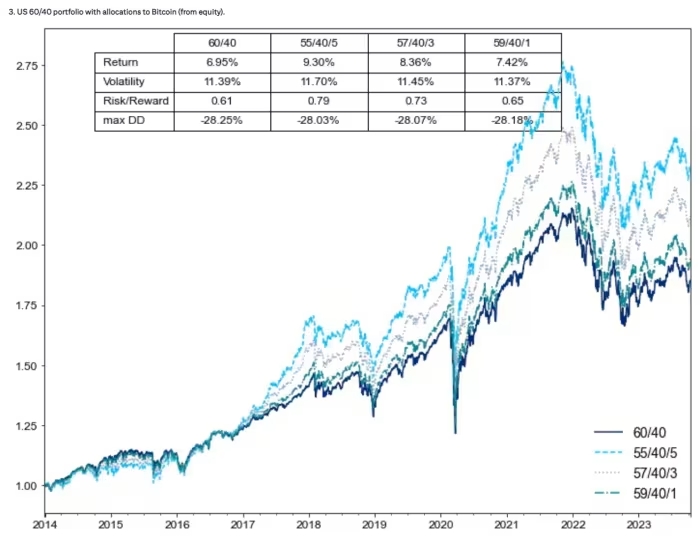

In today’s U.S. trading landscape, an alternative investment strategy to the traditional 60/40 portfolio is gaining attention. Alex Saunders and David Glass of Citi propose a portfolio allocation of 55% stocks, 40% bonds, and 5% bitcoin.

This suggestion becomes more feasible with the introduction of spot bitcoin ETFs, offering easier access to bitcoin investment without the complexities of custody or liquidity associated with physical or futures-based holdings.

While not endorsing cryptocurrencies’ intrinsic value, Citi’s analysts present a compelling argument for incorporating bitcoin. Their analysis indicates that adding a 5% bitcoin allocation can enhance overall portfolio returns without significantly increasing maximum drawdowns.

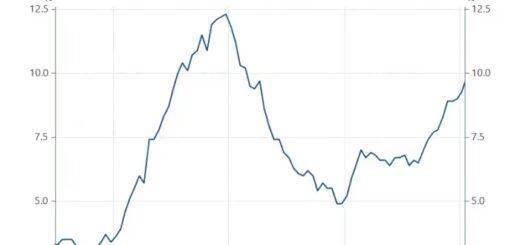

Historical data supports this notion, showing a notable improvement in the Sharpe ratio during the early years. Even after the launch of bitcoin futures and SEC approval, allocating up to 12% to bitcoin could be optimal, catering to investors with varying risk tolerances.

However, future expectations are critical. For a 5% bitcoin allocation to be justified, bitcoin would need to deliver returns surpassing those of traditional asset classes.

With bitcoin’s recent performance and Citi’s model target, there is optimism for meeting or exceeding these expectations.