Goldman Sachs’ Playbook for Range-Bound Markets: Key Strategies Revealed

Early on Friday, futures for stock indices show optimism, although this could change if the nonfarm payrolls report signals strong wage inflation.

The source of this optimism is a 6% rise in Apple shares after the company reported better-than-expected earnings, provided a positive outlook, and proposed additional share buybacks.

Although Apple’s influence on the broader market has diminished somewhat, its significant weighting in the S&P 500 remains positive for overall market sentiment.

Goldman Sachs’ Global Opportunity Asset Locator team, led by Christian Mueller-Glissmann, remains generally positive about equities. They acknowledge challenges such as persistent inflation in the U.S. and consequent pressure on bond yields but maintain a positive outlook for the year. They believe that equities can still perform well in the late cycle without a recession.

As a result, Goldman Sachs retains an overweight position on stocks for both short- and long-term horizons, while being underweight on credit. They point to factors like strong profit margins, robust balance sheets, and increased shareholder returns as reasons for the attractiveness of stocks.

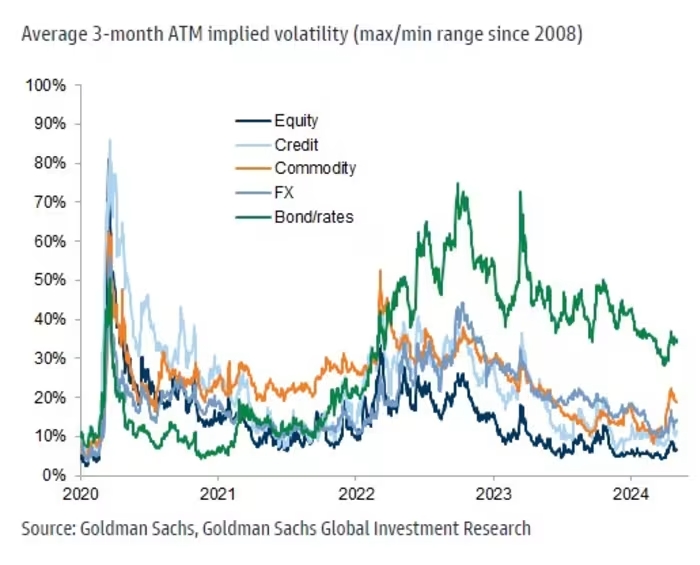

However, they caution that equity volatility may persist until inflation decreases and bond market fluctuations stabilize. With monetary policy support waning, they stress the importance of growth to support risk appetite but note that rising bond yields raise the bar for such growth.

To navigate these challenges, Goldman recommends overweighting cash in the short term to reduce portfolio risk amid tighter equity/bond correlations. They anticipate that in the event of a significant stock market correction, assets from money market funds could flow into equities.

Additionally, Goldman suggests overweighting commodities to diversify against geopolitical risks and potential overheating in late-cycle environments. They see opportunities in oil futures due to recent price declines and anticipate higher gold prices driven by central bank purchases and Chinese demand.

Goldman expresses particular confidence in copper and aluminum, citing factors such as a global manufacturing uptick, green transition initiatives, structural supply deficits, and low inventory levels as supportive of their positive outlook on these commodities.