Quantifying Berkshire’s Apple Advantage: Dividend Hike Breakdown

Apple’s announcement of a 4% increase in its cash dividend brings positive implications for Warren Buffett’s Berkshire Hathaway Inc.

Buffett, famously drawn to dividend-yielding stocks, is likely pleased with Apple’s decision to up its cash dividend to 25 cents per share. Berkshire Hathaway holds over 905 million shares of Apple, accounting for around 6% of the tech giant’s total outstanding shares.

As a significant shareholder, Berkshire stands to gain substantially from Apple’s augmented dividend payout. Assuming Berkshire maintains its current shareholding, its quarterly dividend from Apple would rise to $226.4 million, compared to the previous $217.3 million.

Over the next year, Berkshire could anticipate receiving $905.6 million in Apple dividends, up from $869.4 million prior to the dividend hike, marking a notable increase of over $36 million for the year.

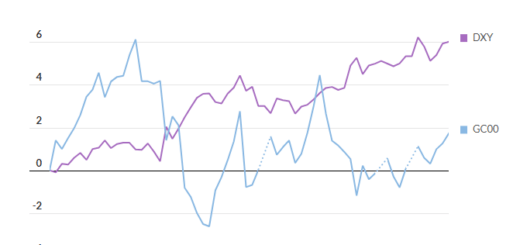

The stability of Berkshire’s Apple position sparks speculation on Wall Street, particularly amidst Apple’s recent stock underperformance, with a 5% decline compared to the S&P 500’s 8% rise this year.

Buffett’s investment portfolio includes other dividend-paying companies such as Coca-Cola Co., Kraft Heinz Co., and Chevron Corp.

In addition to the dividend increase, Apple reported a 10% year-over-year decline in iPhone sales, expanded its stock-buyback program by $110 billion, and addressed some investor concerns regarding its business in China.