Market Alert: Goldman Sachs Highlights Potential Shock Scenarios for Inflation Data

Key Information for Today’s U.S. Trading:

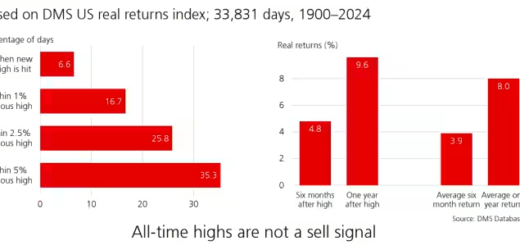

Despite April’s 4.1% drop, May has seen a surprising 3% rise in the S&P 500. Investors are now focusing on the upcoming consumer prices data, particularly the CPI, which Goldman Sachs’ Vickie Chang highlights as crucial for market movements.

Chang emphasizes the importance of the inflation trajectory for the macro outlook, especially after the recent Fed meeting. Next week’s CPI release will be instrumental in shaping market sentiment.

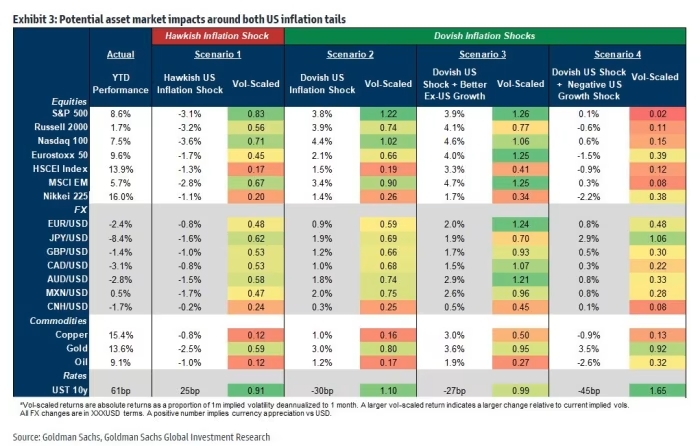

Chang outlines several potential scenarios:

- A “hawkish shock” scenario predicts further Fed tightening due to inflation concerns, which could pressure stocks, elevate bond yields, strengthen the dollar, and lead to commodity sell-offs.

- Conversely, a “dovish policy shock” scenario anticipates market relief from inflation, potentially boosting stocks and commodities while dampening the dollar and bond yields.

- If inflation relief coincides with global growth upgrades, it could weaken the dollar and favor non-U.S. equities.

- In the event of U.S. inflation relief coupled with modest growth worries, impacts on U.S. yields, equities, and the dollar may be more subdued.

The fourth scenario could see upside for bonds, gold, and the yen, although the yen has already experienced a notable uptrend.