Election Year Boom: Key Factors for Sustaining the Stock Market’s Record Rally

U.S. stocks have posted an impressive election-year rally so far in 2024. As investors question whether the rally will continue, they’re closely watching inflation and economic-growth data to gauge the Federal Reserve’s potential interest-rate decisions and corporate earnings in the second half of the year.

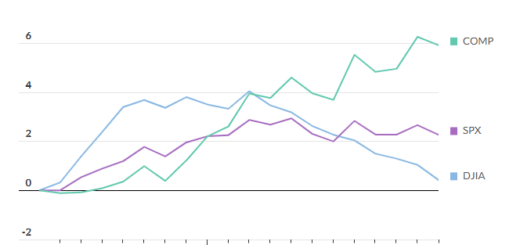

The S&P 500 is on track for its best first-half performance during an election year since 1976 and the second-best performance in an election year in its history, according to Dow Jones Market Data.

However, the rally has “left valuations stretched, sentiment optimistic, and the market overbought,” say analysts at Ned Davis Research.

Several factors leave the U.S. stock market vulnerable to a correction in the second half of the year, the analysts noted — including corporate earnings estimates, uncertainty around potential Fed rate cuts, the upcoming presidential election, and the limited breadth of the market’s rally.

While earnings estimates have been improving since the start of the year — with analysts now expecting earnings growth of 12% to 13% for 2024 — valuations are rising even faster, said Sam Stovall, chief investment strategist at CFRA.

This could be concerning, Stovall told MarketWatch. “We have to see whether the rising stock prices and price-to-earnings ratios are actually the result of the market expecting better earnings,” he said. For now, as investors wait for the second-quarter earnings season to kick off, such data is mostly on the back burner, he added.

Investors are even more concerned about persistent inflation, which together with growth data will influence the timing and magnitude of any interest-rate cuts by the Fed this year, said William Northey, investment director at U.S. Bank. While the Fed has forecasted only one rate cut for the rest of the year, fed-funds futures traders are currently pricing in two cuts starting in September, according to the CME FedWatch Tool.

The most important inflation-related data point to be released next week is the personal-consumption expenditures, or PCE, price index due out Friday. James Ragan, director of wealth-management research at D.A. Davidson, expects the PCE numbers for May to confirm that inflation is slowing, as was reflected in consumer-price index data released earlier this month.

Stovall echoed that point, saying he expects both the headline and core PCE inflation figures to be lower than in the previous month, which may bode well for the stock market.

Meanwhile, economic-growth data remains another major focus, as the market is expecting U.S. GDP growth to slow but stay positive, Ragan noted. “If we get weaker data, it’s not necessarily bad for the market,” he said, as that could spur the Fed to move quicker on rate cuts. “Bad news is good news — as long as it’s not too bad news.”

For the stock market to continue its rally, investors will need to see a broadening of the rally from both a price perspective and an earnings-contribution perspective, said U.S. Bank’s Northey. He observed that so far this year, the stock market’s strength has mostly been driven by megacap tech companies like Nvidia Corp., due to their outsized earnings growth and excitement around artificial intelligence applications.

The S&P 500’s 14.6% gain so far this year has mostly been driven by its information-technology sector, which has risen 28.7%, and its communication-services sector, which has advanced 24.8%, according to FactSet data.

“If the economy is achieving a soft landing and stays positive, we would expect to see better participation from some of the cyclical sectors such as energy, financials, materials, and industrials,” Ragan said. “We should watch those sectors pretty carefully; if they start to perform better, that’s how we’ll have a more sustainable rally.”

U.S. stocks ended this past week higher, with the Dow Jones Industrial Average up 561.17 points, or 1.5%, to 39,150.33, according to Dow Jones Market Data. The S&P 500 finished the week up 33.02 points, or 0.6%, at 5,464.62, while the Nasdaq Composite closed the week up 33.02 points, or 0.6%, at 5,464.62.

Next week, investors will also be watching for new consumer-confidence data on Tuesday, new home-sales data on Wednesday, and initial jobless-claims numbers on Thursday.