Small Caps Shine Amid Market Rotation

Thursday was a rough day for hedge funds heavily invested in megacap tech stocks and shorting the rest of the market. A cooler-than-expected June consumer-price index (CPI) reading ignited a rotation into previously neglected sectors.

“Hedge funds are blowing up today,” said Jay Hatfield, CEO of Infrastructure Capital Advisers, referring to strategies that involve long positions in large-cap tech stocks and short bets against small- and mid-cap stocks.

While this strategy had been profitable during a rally led by a select group of tech giants in 2024, the tide turned abruptly. Small-cap stocks surged, with the Russell 2000 index up 3.6%, while the Nasdaq Composite fell 2%. This marked the biggest one-day outperformance for the Russell over the Nasdaq since records began in 1986, according to Dow Jones Market Data.

The key question for investors is whether this rotation is temporary or the beginning of a broader rally, following a period of concentrated market leadership. Market analysts noted sharp rises in heavily shorted stocks, indicating the squeeze could persist for some time.

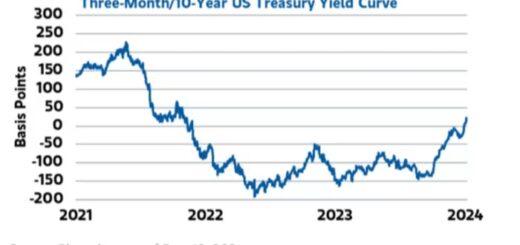

On Thursday, the S&P 500 pulled back 0.9% after hitting a record intraday high, while the Dow Jones Industrial Average gained 0.1%. The consumer-price index fell 0.1% in June, slowing the year-over-year rate to 3%.

The core rate, excluding energy and food costs, rose 0.1%, slowing to 3.3% from 3.4%. Economists warn that more data will be needed to ensure a September rate cut by the Federal Reserve, but fed-funds futures traders now see a better than 90% probability of at least a quarter-point reduction, according to the CME FedWatch Tool.

The Magnificent Seven megacap tech stocks, which had led the rally since October 2022 due to AI enthusiasm, were each down at least 2% by midday Thursday. This resulted in a market cap drop of more than $500 billion, the largest single-day loss since September 13, 2022.

Despite the decline in heavyweight tech stocks dragging down the S&P 500, around 80% of the index’s stocks were higher on the day. The equal-weighted S&P 500 outperformed its market-cap-weighted version by around 1.8 percentage points, marking the biggest relative gain since January 2021.

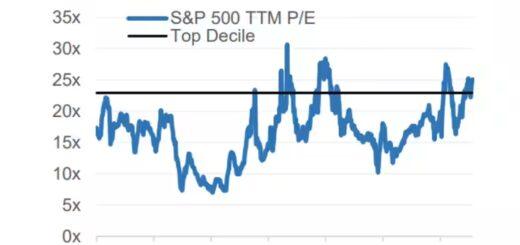

Hatfield, also the portfolio manager of the InfraCap Small Cap Income ETF, sees potential for the rally to broaden as the market anticipates continued cooling inflation readings and eventual Fed rate cuts. He expects the overall market to extend its run, having recently raised his year-end target for the S&P 500 to 6,000.

A September rate cut by the Fed could continue a trend of global central banks injecting liquidity into the banking system, historically boosting both stocks and bonds. Although the S&P 500’s pullback Thursday was exacerbated by the tech selloff, Sonu Varghese, global macroeconomic strategist at Carson Group, believes it won’t be a lasting drag on the index. He anticipates that large-cap value stocks could rally and support the index’s forward momentum, even if tech consolidates.