From Ugly Ducklings to Golden Geese: Finding Potential in Undervalued Stocks

Not long ago, investors were confident in the continuation of the big-tech trade and expected former President Donald Trump to win the upcoming election.

Now, the landscape has shifted. The market is rotating from tech-based momentum trades to the previously unpopular small caps. Investors who were banking on a “Trump-trade” now face the higher probability of a Democratic victory after President Joe Biden exited the race.

This environment of increased volatility and uncertainty is exactly what Ruffer Investment Company has positioned its portfolio for. The London-based fund is wary of equity market valuations, especially in the U.S., and expects global inflationary pressures and growing fiscal deficits to negatively impact bond prices, driving yields higher.

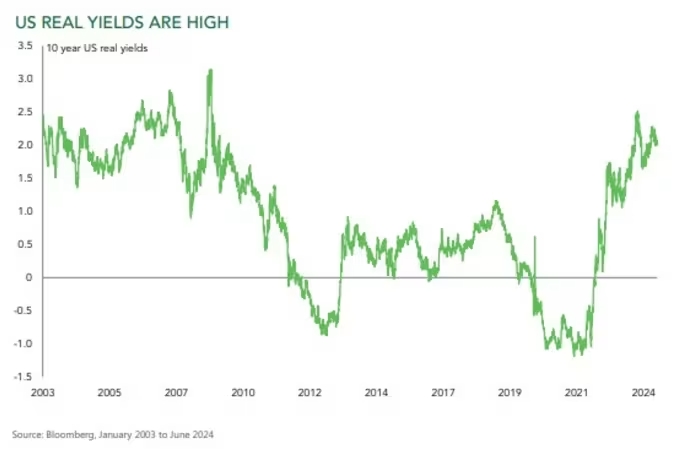

“The risks of a correction in equity and credit markets are high given the level of real interest rates alongside the uncertainty driven by elections, central bank policy decisions, liquidity risks, and a softening U.S. economy,” says Ruffer in its fiscal year-end review.

Ruffer’s portfolio includes what it calls deeply unloved “ugly ducklings.” These assets, often overlooked by investors, have the potential to transform into valuable investments. Among the ugliest ducklings are Chinese shares, which are under-owned due to reputational risks. Ruffer finds these equities attractive because they are among the cheapest globally, despite bad news being priced in.

Ruffer allocates only a quarter of its funds to stocks, with Chinese equities comprising around 4% of its portfolio. U.K. equities account for 11.2%, benefiting from low valuations and the potential for a re-rating driven by a stable new Labour government, increased pension fund stock holdings, and foreign takeover interests.

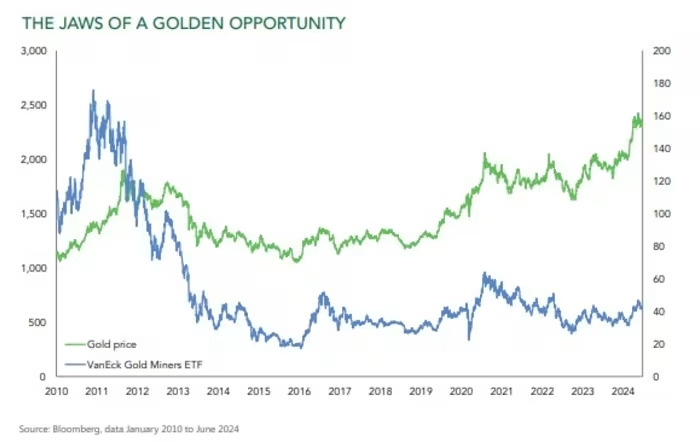

Precious metals miners are also part of Ruffer’s portfolio, with 4% in gold mining equities and another 3% in silver and platinum. Ruffer sees value in this sector due to geopolitical concerns, inflation worries, and tax avoidance strategies. They believe earnings revisions in the sector could be spectacular if gold prices rise significantly.

Ruffer also holds a long position in the Japanese yen, viewing its current valuation as a “historic opportunity” and expecting the yen to benefit from its haven status during market volatility.

Finally, U.S. treasury inflation-protected securities (TIPS) and UK inflation-linked gilts make up 19% of Ruffer’s portfolio, reflecting the fund manager’s concerns about persistent inflation. Investors can currently secure a return of inflation plus 2% by lending to the U.S. for the next 10 years, which Ruffer considers a sensible core holding for capital preservation.