Volatility Strikes: Historical Trends to Watch

The recent upheaval in the U.S. stock market has served as a stark reminder of volatility after an unusually long period of calm, which could signal a shift in market sentiment, according to Jason Goepfert, founder and senior research analyst at SentimenTrader.

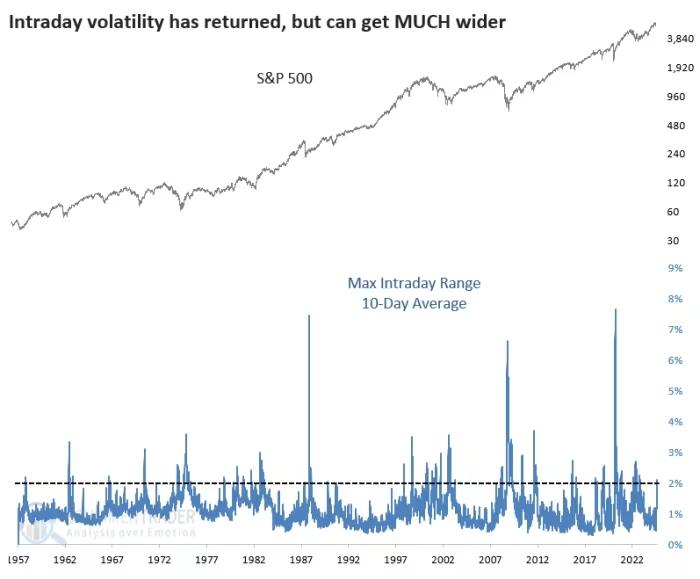

For eight consecutive sessions, the S&P 500 index moved at least 1% intraday, driven by concerns over a weakening U.S. economy and the unwinding of a Japanese yen carry trade. This volatility marked the end of a 430-session streak without a 2% 10-day average intraday move.

Over the past 10 trading days, the index’s intraday range averaged over 2%, making it one of the most volatile periods in the last decade.

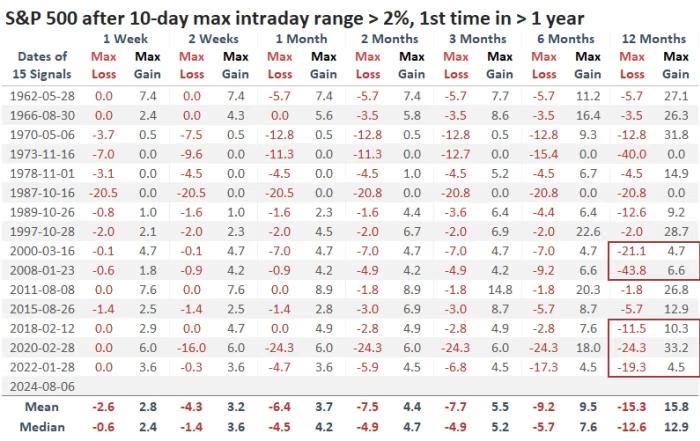

Goepfert pointed out that while intraday volatility spikes have historically led to a temporary market shakeout followed by a recovery, the past 25 years show that these spikes have sometimes resulted in more risk than reward over the following year.

For instance, while the 2011 and 2015 volatility spikes were good entry points for long-term investors, other periods led to more significant risks.

He warned that if the S&P 500 continues to experience lower lows, it might indicate a shift towards defensive stocks.

As of Monday afternoon, the major U.S. indexes were mixed, with the S&P 500 down 0.1%, the Dow Jones Industrial Average down 0.5%, and the Nasdaq Composite up 0.2%, according to FactSet data.