S&P 500 Erases Losses Amid Fading Recession Worries

Stocks Rally as Economic Data Eases Recession Fears

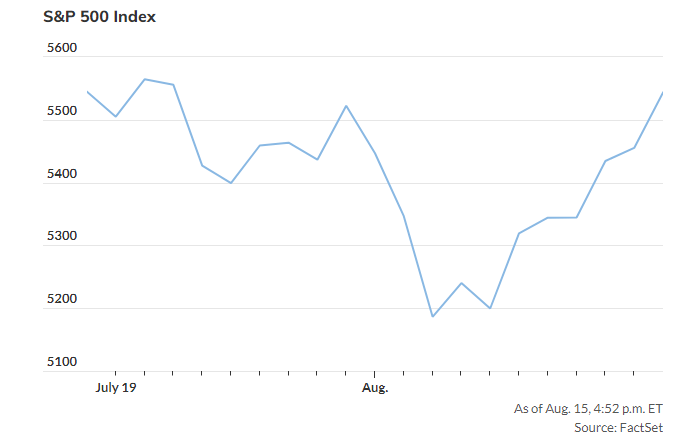

The S&P 500 erased its August losses on Thursday, marking a sharp reversal after the index experienced its worst start to a month in eight years. By the close, the S&P 500 was up 0.4% for August, while the Nasdaq Composite was only slightly down.

Analysts attribute the recovery to encouraging economic data and strong earnings reports. Retail sales saw their largest increase in 18 months, and jobless claims came in lower than expected. These positive signals helped to counteract fears of a looming recession and increased the likelihood of a 25-basis-point rate cut by the Federal Reserve next month.

Walmart’s impressive earnings also contributed to a broad market rally, with consumer-focused stocks leading the way. The S&P 500’s consumer-discretionary sector had its best day of the year, and a “broad-based buying wave,” as described by Mike O’Rourke of Jones Trading, lifted both tech stocks and cyclical sectors.

Jay Hatfield of Infrastructure Capital Advisors noted that the market’s rebound was a response to the “irrational recession fears” that emerged earlier in the month. Despite a rocky start to August, including a spike in the VIX to levels not seen since the pandemic, the market quickly recovered. The VIX has since dropped 60%, its fastest decline on record.

Over the past six days, the S&P 500 has climbed 6.6%, and the Nasdaq has gained 8.6%, marking their best performance since November 2022. Technology stocks have led the charge, with the S&P 500’s tech sector up 11.5% in the same period. Small-cap stocks have also rebounded, with the Russell 2000 index rising 2.5% on Thursday.

Looking ahead, analysts expect continued support for stocks from strong economic data. However, as O’Rourke warned, if the data remains too strong, it might reduce the need for further rate cuts.