Brace for Impact: 2024’s Volatile Election Year for Stocks

Analysts are cautioning investors to expect heightened stock market volatility as the 2024 presidential election approaches on November 5.

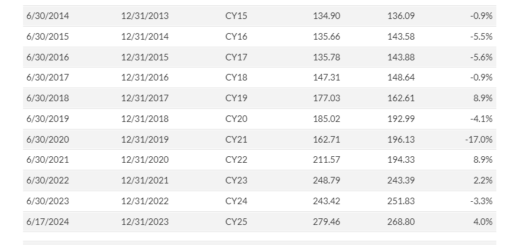

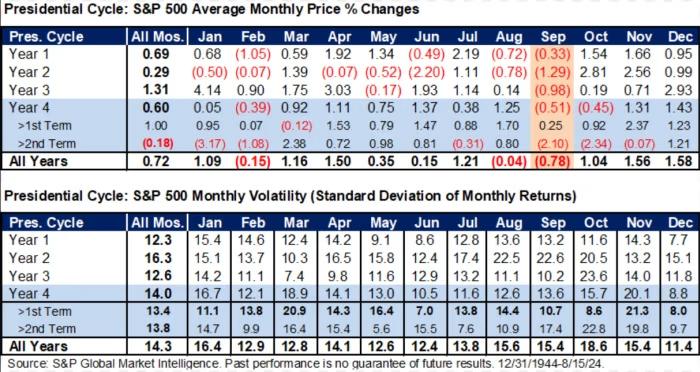

Although recent economic data suggests that the Federal Reserve might begin cutting interest rates, providing some relief to U.S. financial markets, the upcoming election season is likely to bring increased uncertainty. Historically, election years have seen the S&P 500 underperform, with September often being the weakest month.

According to CFRA Research, the S&P 500 has averaged a 0.8% decline in September during election years dating back to 1944.

Sam Stovall, chief investment strategist at CFRA Research, highlights that August and September have consistently been among the worst months for the stock market during election years, with September showing the largest declines.

October, while typically producing gains of over 1%, has been the most volatile month during election years, with a standard deviation 35% higher than other months, reflecting significant market fluctuations.

The outcome of the election could also heavily influence market behavior. Historically, volatility has increased when the incumbent party loses the White House, as markets brace for potential policy changes.

This year, the switch from President Joe Biden to Vice President Kamala Harris as the Democratic nominee has added another layer of uncertainty, particularly with Harris leading in polls against Republican nominee Donald Trump.

Sector-specific impacts are also in focus. The healthcare industry, which has seen strong performance, could face challenges if Harris wins, especially regarding potential drug pricing reforms. This sector rotation could contribute to further market volatility as Election Day nears, potentially driving up the Cboe Volatility Index (VIX).

Given the uncertain political landscape, investors should prepare for potential market turbulence in the weeks leading up to the election.