Is a Market Crash Looming? Signs of Overvaluation

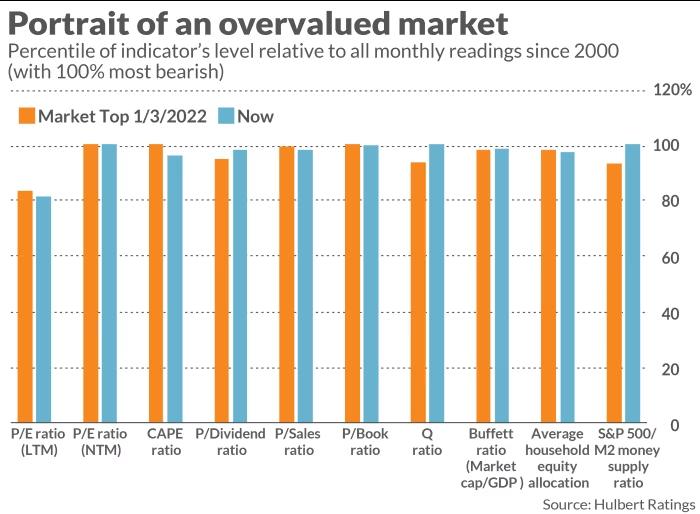

The U.S. stock market is approaching the high valuation levels last seen at the peak on January 3, 2022.

When it recovers from a correction and approaches a new all-time high, it’s essential to compare current valuations with those at previous peaks. Investors often expect these downturns to eliminate prior excesses, setting the stage for a more sustainable bull market.

Unfortunately, this isn’t happening with the S&P 500 (SPX) right now. The chart below shows where various valuation indicators currently stand relative to their monthly distribution since 2000. A 100% reading signals an extremely bearish scenario, while 0% reflects the most bullish.

As the chart highlights, many of these indicators are hovering near the bearish end of the spectrum, close to—or even exceeding—the levels observed at the January 2022 peak.

This doesn’t necessarily mean the stock market won’t keep rising. However, if it does, it will enter even riskier territory than before the 2022 bear market.

Overvaluation doesn’t automatically trigger a market downturn, as valuations have limited predictive power over short-term horizons. But the indicators in this chart have a strong track record of forecasting returns over the next decade. As noted last month, they suggest that returns through 2034 may fall below inflation.

How today’s valuations compare to the past

The percentiles in the chart are based on monthly data since 2000, focusing on this period as some argue that older data is less relevant. Even if we accept this viewpoint, the market is still significantly overvalued.

Extending the analysis to include data since 1970 or 1950 reveals an even more overvalued market.

Any way you look at it, the stock market is dangerously overvalued.