Gold Surges Ahead of Stocks and Bonds in Q3

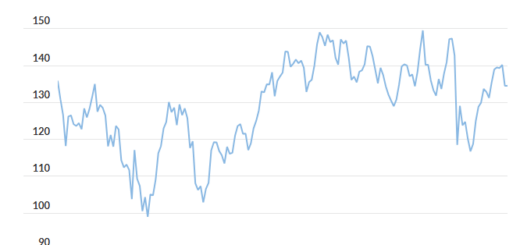

The SPDR Gold Shares ETF saw a strong surge in the third quarter, fueled by growing investor optimism that the Federal Reserve could successfully achieve a “soft landing” for the U.S. economy.

By the end of September, many investors appeared more confident that the Fed could lower inflation without triggering a recession.

“There’s more confidence that we’re going to stick the soft landing,” said Michael Arone, chief investment strategist at State Street Global Advisors.

However, Arone also noted that such outcomes are rare, and gold’s strong performance suggests that some investors are still hedging against economic risks. The SPDR Gold Shares ETF (GLD), which invests in physical gold, has soared 27.1% this year, including a 13% rise in the third quarter. This outpaced the S&P 500, which gained 5.5% during the same period and is up 20.8% for the year.

September marked the start of the Fed’s interest-rate-cutting cycle, with the central bank opting for a larger-than-expected half-point reduction. This move sparked a rally in U.S. bonds, as the iShares Core U.S. Aggregate Bond ETF (AGG), which tracks investment-grade bonds, gained 5.3% in the third quarter.

Meanwhile, riskier corporate bonds, like the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), saw a 5.7% gain.

Despite the optimism, Arone recommends maintaining a small allocation to gold as a hedge against potential risks. He suggests that long-term investors consider a 3% to 10% allocation, emphasizing that falling interest rates make gold an increasingly attractive asset.

As the “opportunity cost” of holding gold declines, it remains a valuable safeguard, especially if the economic outlook shifts unexpectedly.